Exhibit 99.1

Independent Auditor’s Report

Stockholders

Residential Mortgage Services Holdings, Inc. and Subsidiary

Report on the Financial Statements

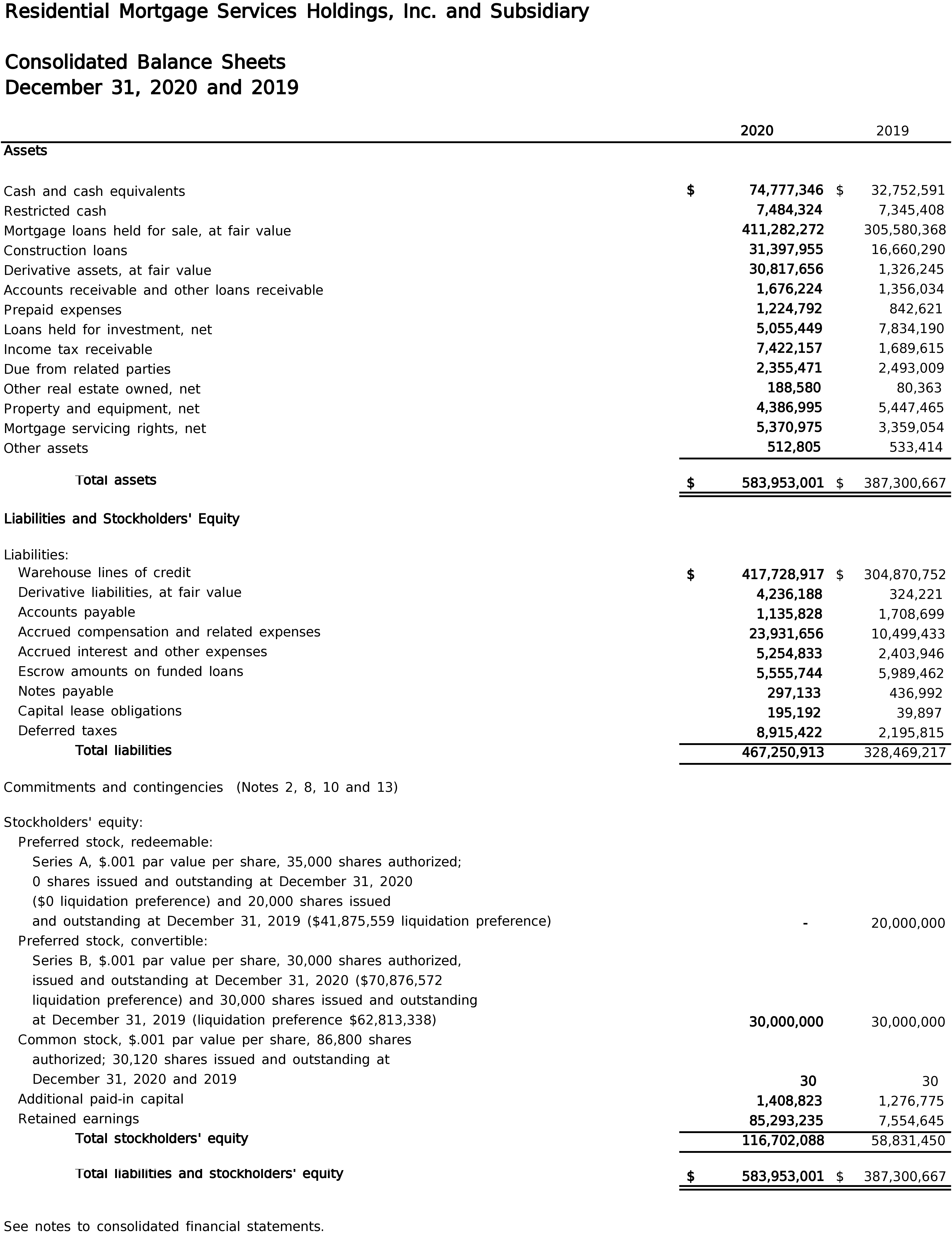

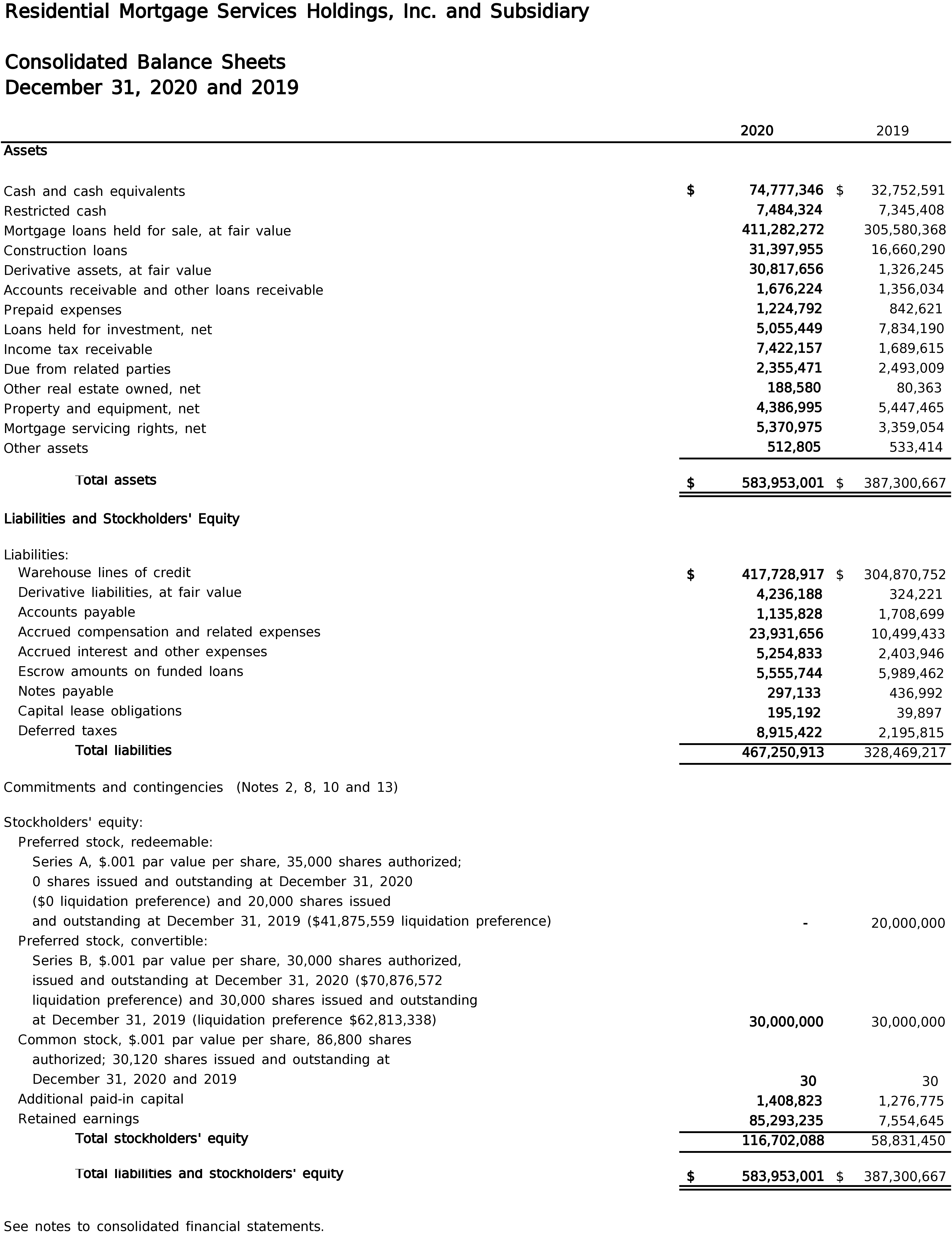

We have audited the accompanying consolidated financial statements of Residential Mortgage Services

Holdings, Inc. and Subsidiary (the Company), which comprise the consolidated balance sheets as of

December 31, 2020 and 2019, the related consolidated statements of operations, changes in

stockholders’ equity and cash flows for the years then ended, and the related notes to the consolidated

financial statements (collectively, the financial statements).

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in

accordance with accounting principles generally accepted in the United States of America; this includes

the design, implementation and maintenance of internal control relevant to the preparation and fair

presentation of financial statements that are free from material misstatement, whether due to fraud or

error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audits. We

conducted our audits in accordance with auditing standards generally accepted in the United States of

America. Those standards require that we plan and perform the audit to obtain reasonable assurance

about whether the financial statements are free from material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in

the financial statements. The procedures selected depend on the auditor’s judgment, including the

assessment of the risks of material misstatement of the financial statements, whether due to fraud or

error. In making those risk assessments, the auditor considers internal control relevant to the entity’s

preparation and fair presentation of the financial statements in order to design audit procedures that

are appropriate in the circumstances, but not for the purpose of expressing an opinion on the

effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also

includes evaluating the appropriateness of accounting policies used and the reasonableness of

significant accounting estimates made by management, as well as evaluating the overall presentation of

the financial statements.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for

our audit opinion.

Opinion

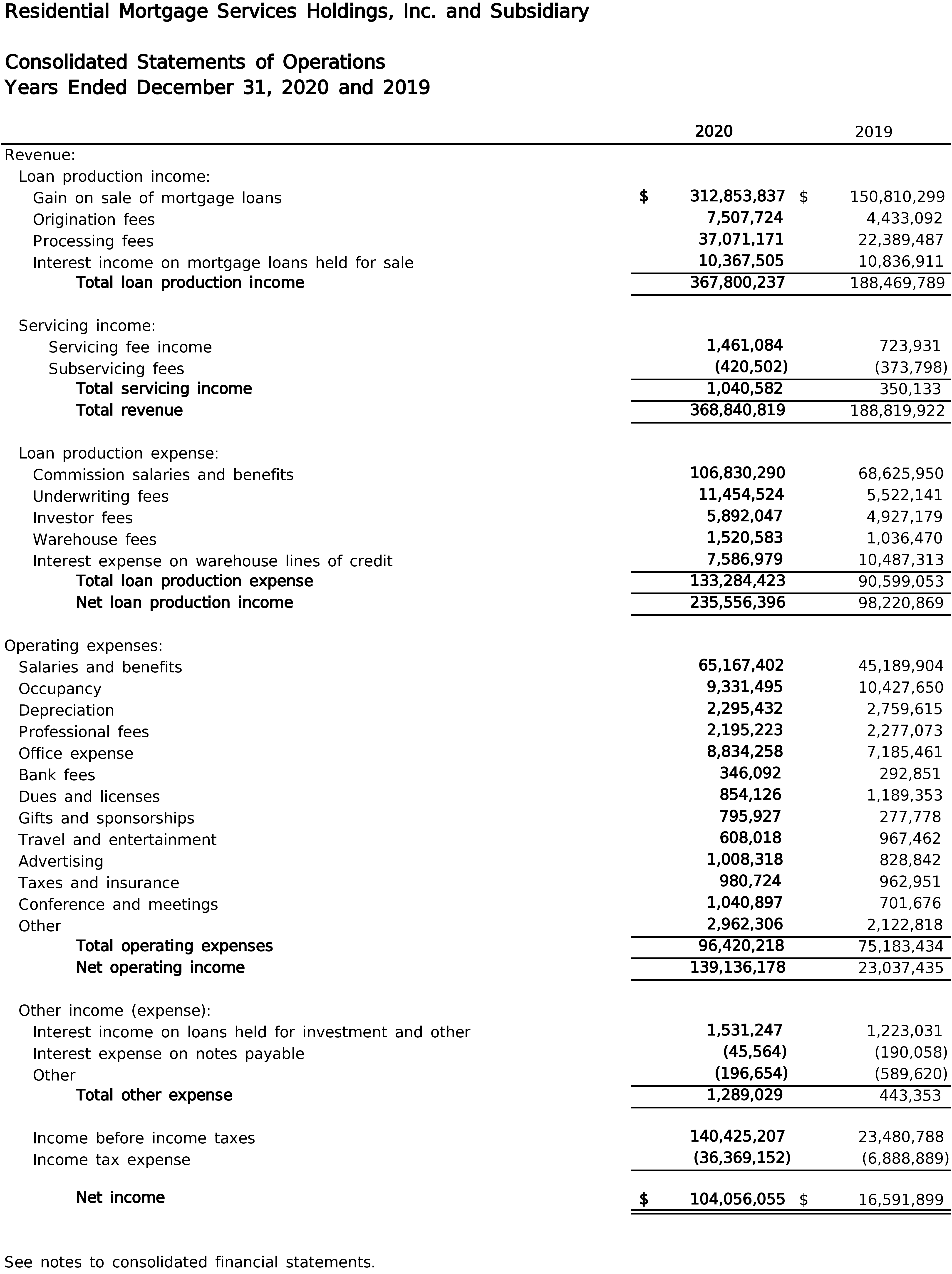

In our opinion, the financial statements referred to above present fairly, in all material respects, the

financial position of the Company as of December 31, 2020 and 2019, and the results of its operations

and its cash flows for the years then ended in accordance with accounting principles generally accepted

in the United States of America.

Other Matters

Our audits were conducted for the purpose of forming an opinion on the financial statements as a

whole. The consolidating information is presented for purposes of additional analysis rather than to

present the financial positions and results of operations of the individual companies and is not a

required part of the financial statements. Such information is the responsibility of management and was

derived from and relates directly to the underlying accounting and other records used to prepare the

financial statements. The consolidating information has been subjected to the auditing procedures

applied in the audit of the financial statements and certain additional procedures, including comparing

and reconciling such information directly to the underlying accounting and other records used to

prepare the financial statements or to the financial statements themselves, and other additional

procedures in accordance with auditing standards generally accepted in the United States of America. In

our opinion, the information is fairly stated in all material respects in relation to the financial statements

as a whole.

/s/ RSM US LLP

New York, New York

March 31, 2021

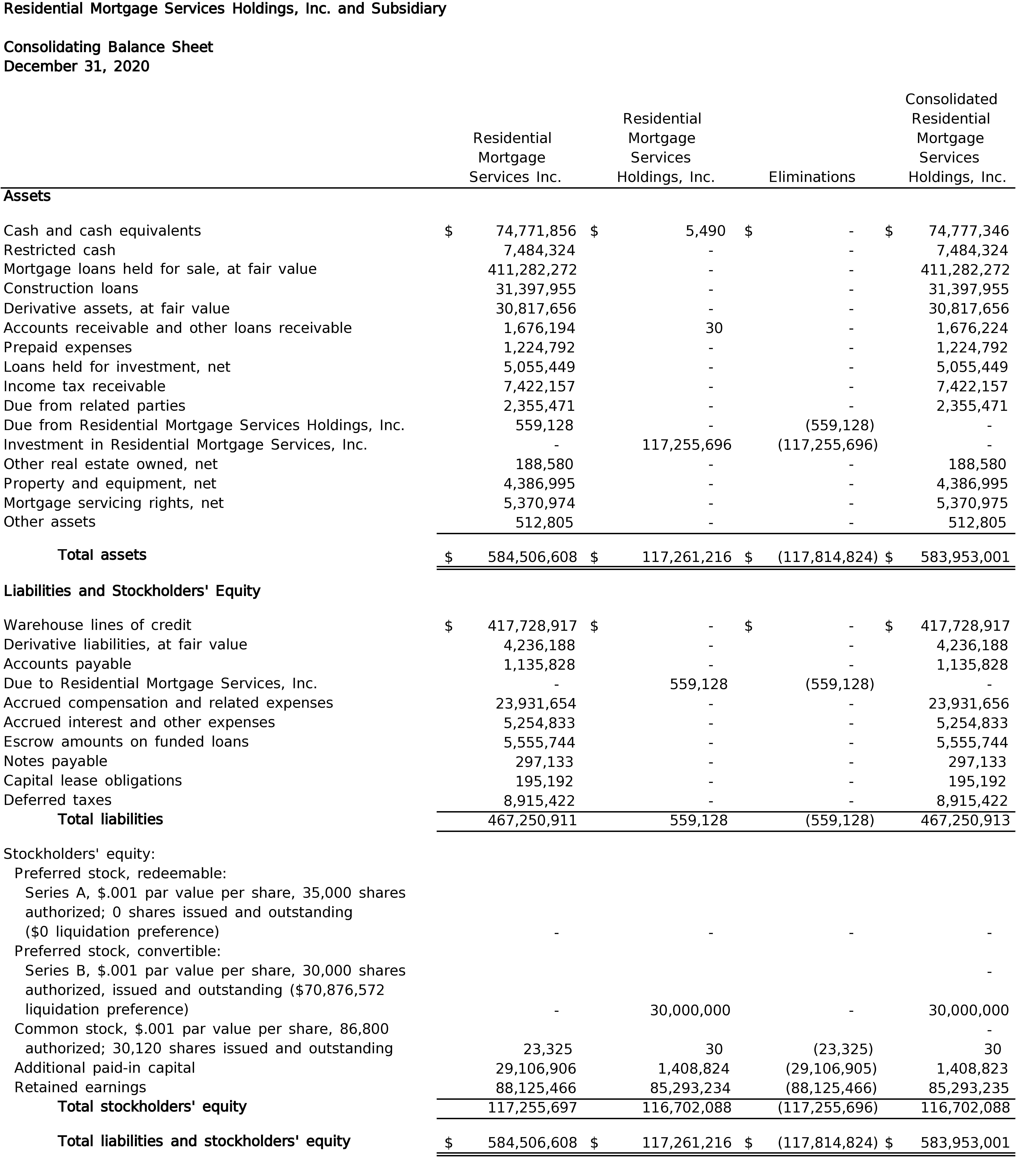

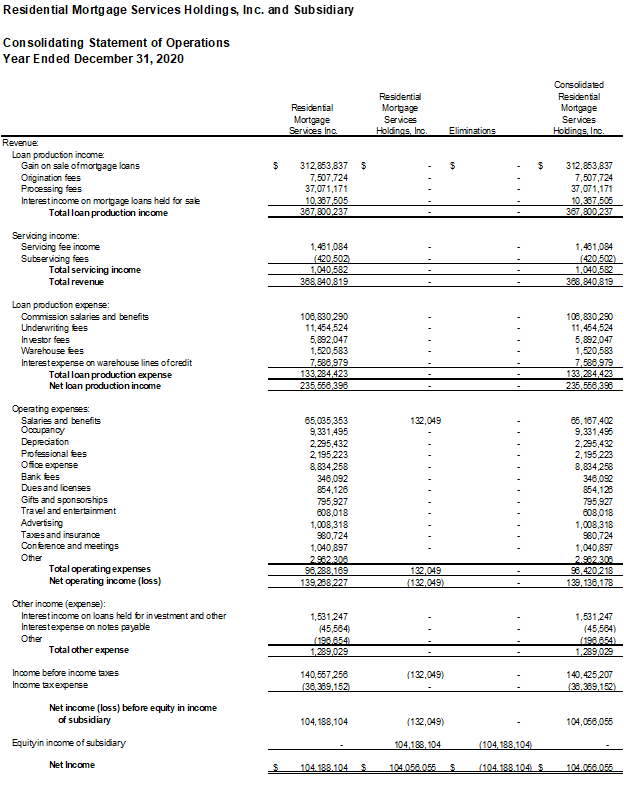

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 1. Summary of Significant Accounting Policies

Principles of consolidation and nature of business: The consolidated financial statements include the accounts of Residential Mortgage Services Holdings, Inc. (Holdings) and its wholly owned subsidiary Residential Mortgage Services, Inc. (RMSI) (collectively, the Company). All significant intercompany balances and transactions have been eliminated in consolidation.

Holdings, a Delaware corporation, was formed in September 2013 to affect the recapitalization of RMSI.

RMSI, a Maine corporation incorporated in 1991 as a mortgage company, is the Company’s operating unit. RMSI originates residential loans for the purpose of selling such loans along with servicing rights to permanent investors in the secondary market. Loans are funded through warehouse lines of credit and are sold to investors generally within 30 days of origination. RMSI’s primary market areas are Southern Maine, New Hampshire, Massachusetts, Rhode Island, Connecticut and the mid-Atlantic region. For the years ended December 31, 2020 and December 31, 2019, 66% and 60%, respectively, of RMSI’s loans originated for sale were sold to four investors.

The Company is subject to supervision and examination by state and federal regulatory authorities. Failure to comply with regulatory guidelines could subject the Company to various sanctions and penalties.

In the normal course of business, companies in the mortgage banking industry encounter certain economic and regulatory risks. Economic risks include interest rate risk and credit risk. The Company is subject to interest rate risk to the extent that in a rising interest rate environment, the Company may experience a decrease in loan production, as well as decreases in the value of mortgage loans held for sale and in commitments to originate loans, which may negatively impact the Company’s operations. Credit risk is the risk of default that may result from the borrowers’ inability or unwillingness to make contractually required payments during the period in which loans are being held for sale.

Basis of presentation: The consolidated financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP).

Use of estimates: The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements. Estimates also affect the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Material estimates that are susceptible to material change in the near term include the fair value estimates for loans held for sale and derivative financial instruments.

Mortgage loans held for sale: Mortgage loans held for sale to permanent investors are stated at aggregate fair value using current secondary market prices for loans with similar coupons, maturities, and credit quality. Changes in fair value are recognized in earnings and fees and costs associated with origination of loans held for sale are recognized in earnings as incurred. Management believes that accounting for mortgage loans held for sale at fair value is consistent with industry practices.

Transfer of financial assets: Mortgage loans held for sale are considered de-recognized, or sold, when the Company surrenders control over the financial assets. Control is considered to have been surrendered when the transferred assets have been isolated from the Company, beyond the reach of the Company and its creditors; the purchaser obtains the right (free of conditions that constrain it from taking advantage of the right) to pledge or exchange the transferred assets; and the Company does not maintain effective control over the transferred assets through an agreement that both entitles and obligates the

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 1. Summary of Significant Accounting Policies (Continued)

Company to repurchase or redeem the transferred assets before their maturity or the ability to unilaterally cause the holder to return specific assets.

If the criteria above are not met, such transfers are accounted for as secured borrowings, in which the assets remain on the balance sheet, and the proceeds from the transaction are recognized as a liability.

Revenue recognition: Gains and losses from the sale of mortgages are recognized based upon the difference between the sales proceeds and carrying value of the related loans upon sale and is recorded in gain on mortgage loans held for sale in the statement of operations. The sales proceeds reflect the cash received. Gain on mortgage loans held for sale also includes the unrealized gains and losses associated with the mortgage loans held for sale.

Derivative instruments and hedging activities: The Company utilizes certain derivative instruments in the ordinary course of business to manage exposure to changes in interest rates. These derivative instruments include “to be announced mortgage-backed securities” (TBAs). The Company also issues interest rate lock commitments (IRLCs) to borrowers in connection with mortgage loan originations, which are also considered derivatives. All derivative instruments are recorded at fair value. The estimated fair values of TBAs and forward sale commitments are based on the prices of similar instruments observed in the market and are recorded as derivative assets or liabilities in the consolidated balance sheets. The changes in fair value of TBAs and forward sale commitments are recorded in current earnings. The estimated fair values of IRLCs are based on internal valuation models. Fair value amounts of IRLCs are adjusted for expected execution of outstanding loan commitments with changes in fair value recorded in current earnings (see Note 2).

Construction loans: The Company in 2018 began extending residential real estate construction loans to customers. The Company funds the construction loans with the intent to sell the term loan upon completion of the construction process. The underwriting process for construction loans is similar to mortgage loans held for sale and requires a credit analysis, employment history and an analysis of the secured real estate process.

Loans held for investment and allowance for loan losses: Loans held for investment are recorded at the principal amount outstanding, net of an allowance for loan losses. The Company reviews its loan portfolios to determine whether an allowance is necessary to absorb losses that are estimated to have occurred. Loans are charged-off when deemed uncollectible. Loans are evaluated for delinquency based on payment terms. The Company has reviewed its loan portfolio and has determined that a $738,794 and $960,779 allowance for loan losses on loans held for investment is required at December 31, 2020 and 2019, respectively.

Loans are considered impaired when it is probable the Company will be unable to collect all amounts due according to the contractual terms. Impairment is measured based on the discounted expected future cash flows or the fair value of the collateral securing the loan if the loan is collateral dependent.

Interest income on loans is recognized on the accrual basis of accounting when interest is probable of collection. Management stops accruing interest when it is determined that collection is not assured.

There was one impaired loan with an unpaid balance of $144,001 at December 31, 2019, which was foreclosed on in 2020 and added to the other real estate owned portfolio, with a loan loss reserve related to that loan of $35,784 which was included in the total reserve of $960,779. At December 31, 2020, there

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 1. Summary of Significant Accounting Policies (Continued)

were no impaired loans. The applied reserve is based on the fair value of the property held in portfolio. There were no charge offs incurred at December 31, 2020 and 2019.

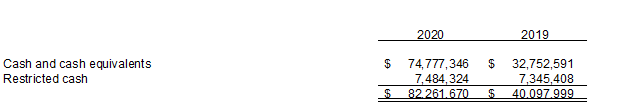

Property and equipment: Property and equipment is stated at cost, less accumulated depreciation. Routine repairs and maintenance are charged against income. Expenditures which increase values, change capacities or extend useful lives are capitalized. Depreciation is computed using the straight-line method over the estimated useful lives of the assets. Assets held under capital lease arrangements are amortized over the term of the lease or the useful life if shorter.

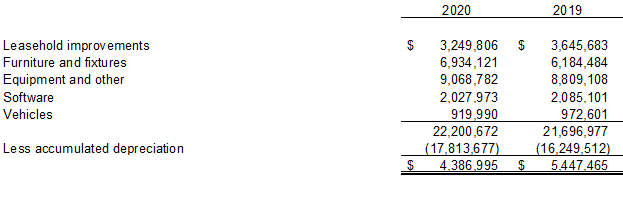

Mortgage servicing rights: The Company sells residential mortgage loans in the secondary market and retains the right to service certain loans sold. Mortgage servicing rights (MSRs) retained are initially measured at fair value and have been recognized as a separate asset and are being amortized in proportion to and over the period of estimated net servicing income.

Mortgage servicing rights are periodically evaluated for impairment based on the fair value of those rights. Impairment is evaluated by discounting the expected future cash flows, taking into consideration the estimated level of repayments based on current industry expectations and the predominant risk characteristics of the underlying loans, including loan type, note rate and loan term. Impairment losses are recorded as a component of income, thereby establishing a new cost basis of the MSRs. The Company has recorded impairment losses on the MSRs of $663,957 and $568,773 for the year ended December 31, 2020 and 2019, respectively.

Other real estate owned: Other real estate owned is recorded at estimated fair value, less estimated costs to sell, based on outside appraisals performed on the properties. Expenditures which increase values are capitalized. The Company has recorded an allowance for losses on other real estate owned of $268,251 and $232,467 for December 31, 2020 and 2019, respectively.

Advertising: The Company expenses the costs of advertising as incurred.

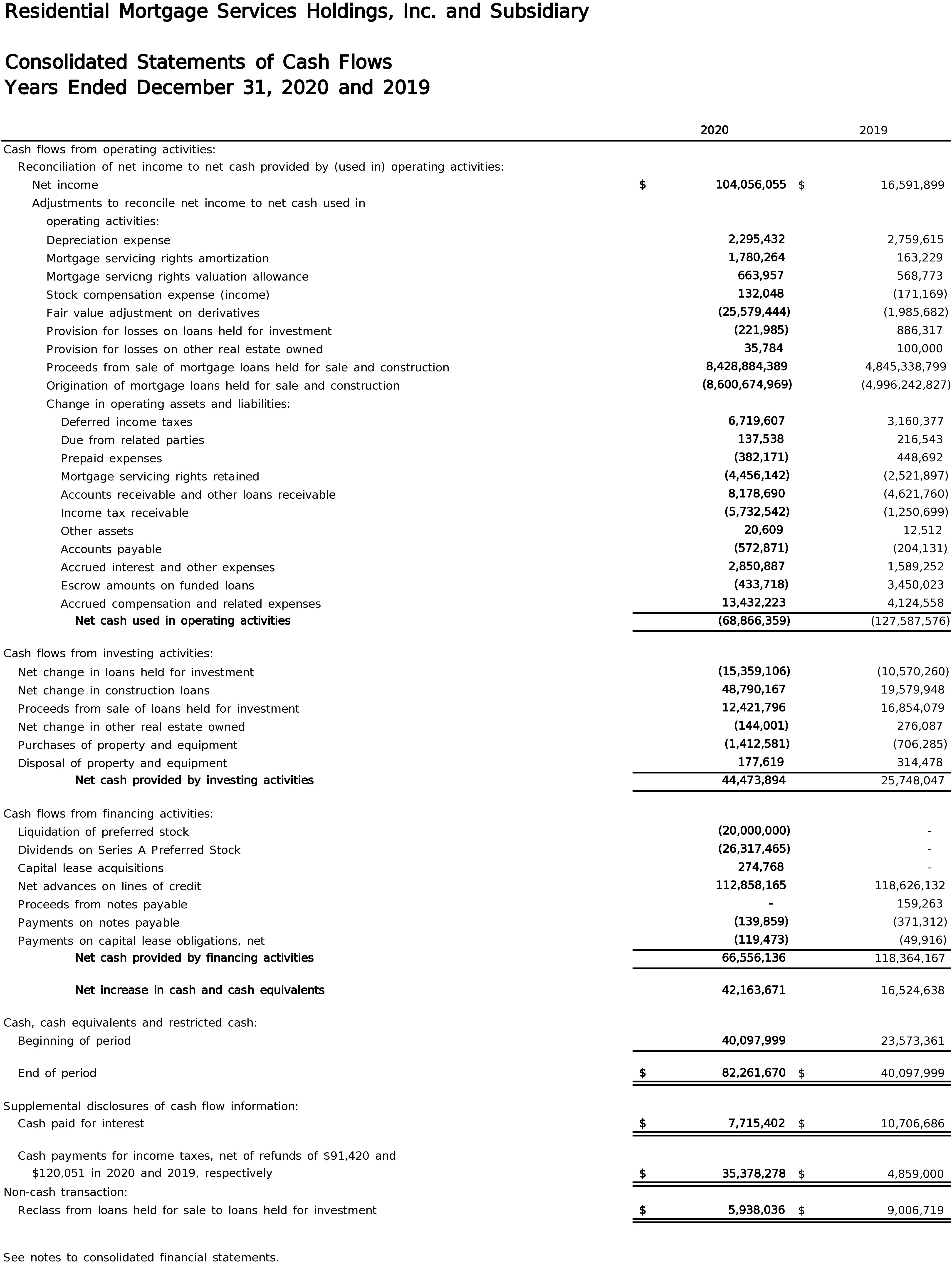

Cash and cash equivalents, restricted cash and certificates of deposit: Cash and cash equivalents consist of highly liquid investments with an original maturity of three months or less. At December 31, 2020 and December 31, 2019, cash equivalents consist of $64,088,036 and $28,301,068, respectively, invested in an overnight sweep account.

The Company maintains its cash and cash equivalents, restricted cash, which, at times, may exceed federally insured limits. The Company has recorded cash and cash equivalents, restricted deposits and a certificate of deposit amounting to $82,261,670 and $40,097,999 as of December 31, 2020 and 2019, respectively. The Company has not experienced any losses in such accounts and the Company believes it is not exposed to any significant risk. At December 31, 2020 and 2019, the Company had cash on deposit, including restricted cash, at 14 institutions in the amount of $83,981,484 and $40,971,514 respectively, which exceeds the federally insured limits of $250,000 per institution. Differences between the amounts in the bank and the balances recorded in the accompanying consolidated balance sheets are due to outstanding checks and deposits in-transit.,

At December 31, 2020 and December 31, 2019, restricted cash deposits of $7,484,324 and $7,345,408, respectively, were maintained in bank deposit accounts to serve as cash reserves under warehouse lines of credit agreements.

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 1. Summary of Significant Accounting Policies (Continued)

The following table provides a reconciliation of the cash, cash equivalents and restricted cash reported within the consolidated statement of cash flows.

Long-lived assets: Long-lived assets are evaluated for impairment whenever events or changes in circumstances indicate that an asset may not be recoverable. Management determined that no events or circumstances have occurred which would require an evaluation of impairment of such assets during the years ended December 31, 2020 and 2019.

Income taxes: Income taxes are provided for the tax effects of transactions reported in the consolidated financial statements and consist of taxes currently due plus deferred taxes. Deferred taxes are provided for the temporary differences between the tax basis of the Company’s assets and liabilities and their reported amounts. Deferred tax assets and liabilities are determined based on the enacted rates that are expected to be in effect when these differences are expected to reverse. Deferred tax expense or benefit is the result of the changes in the deferred tax assets and liabilities. Deferred tax assets are reduced by a valuation allowance if, based on the weight of evidence available, it is more likely than not that some portion or all of a deferred tax asset will not be realized.

Assets and liabilities are established for uncertain tax positions taken or positions expected to be taken in income tax returns when such positions are judged to not meet the “more-likely-than-not” threshold, based upon the technical merits of the position. Estimated interest and penalties, if applicable, related to uncertain tax positions are included as a component of income tax expense. Management of the Company has evaluated the positions taken on its tax returns filed and the potential impact on its tax status as of December 31, 2020 and 2019. The Company has concluded no uncertain income tax positions exist at December 31, 2020 and 2019. The Company’s tax years from 2015 to 2019 are open and subject to examination.

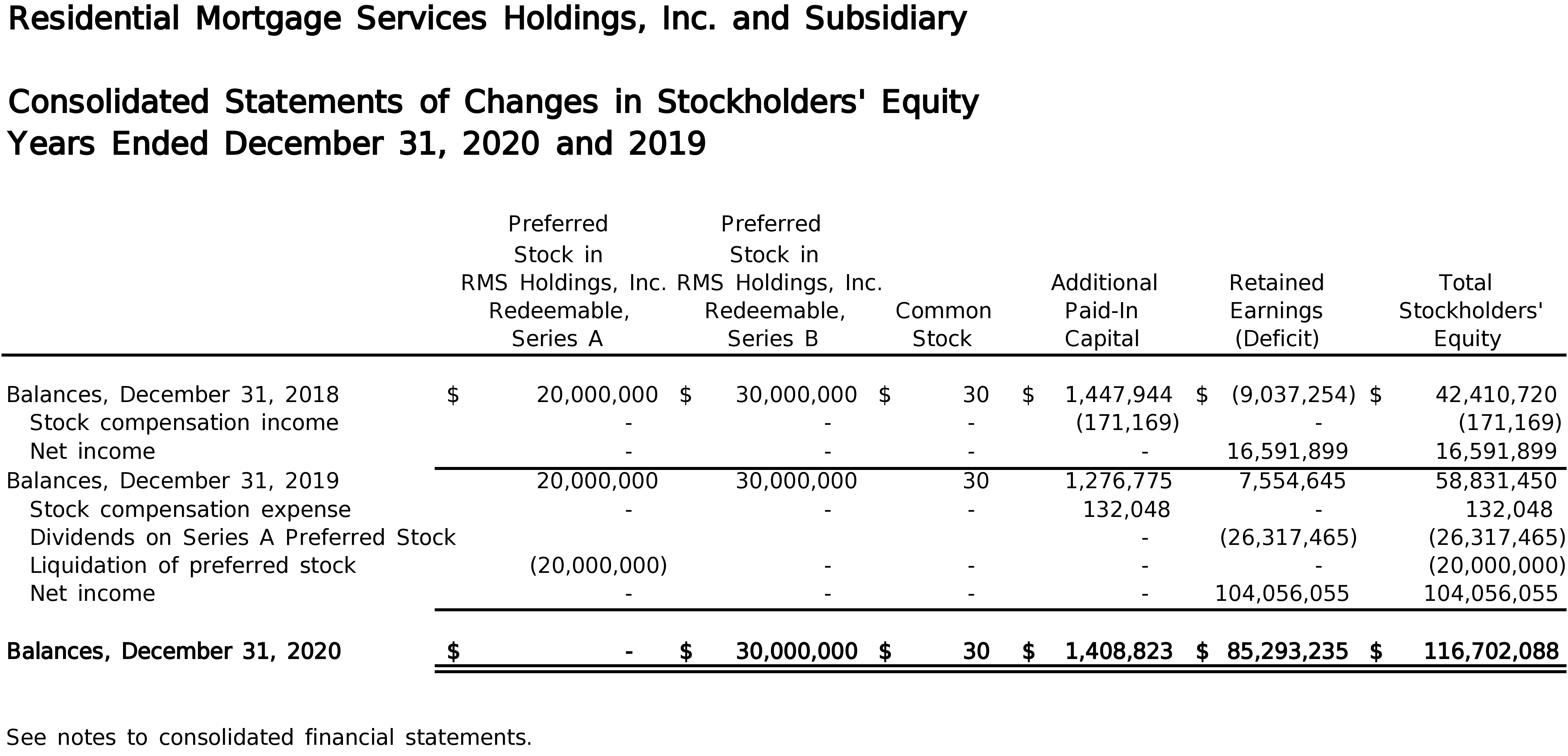

Stock-based compensation: Stock-based compensation is measured at the grant date based on the fair value of the award as estimated by management and is recognized as expense over the requisite service period or vesting period of the award using the straight-line method. The Company estimates the grant date fair value using the Black-Scholes option pricing model. This option valuation model requires the input of several subjective assumptions.

The Company has a 2013 Stock Incentive Plan (the Plan) which provides for granting of options to purchase shares of the Company’s common stock to employees, consultants, advisors and directors at the discretion of the Board of Directors. The Company has authorized 6,680 shares for grant under the Plan. There were 4,743 options outstanding at December 31, 2020 and 2019. There were 1,136 options that became vested, and no options exercised during the year ended December 31, 2020. The total compensation expense recorded was $132,048 during the year ended December 31, 2020. The compensation expense recorded of ($171,169) for the year ended December 31, 2019 is comprised of $172,956 of compensation expense related to the vesting of outstanding options during 2019 and the reversal of ($344,125) of compensation expense related to the forfeiture of options awarded to a former employee of the Company. These amounts are recorded within the salaries and benefits operating expense line item on the consolidated income statement. Total unrecognized compensation expense

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 1. Summary of Significant Accounting Policies (Continued)

related to non-vested options as of December 31, 2020 and 2019 amounts to $19,840 and $151,888, respectively.

In March 2020, the World Health Organization recognized COVID-19 as a pandemic and the President of the United States declared the COVID-19 outbreak a national emergency. Stringent measures were implemented by countries and local municipalities to help control the spread of the virus, followed by phased regulations and guidelines for reopening communities and economies. The pandemic and resulting measures have had a significant impact on national and global economies. COVID-19 has not had a material adverse impact on the Company’s operations, cash flows, financial position or the amount or availability of its liquidity.

Recent accounting pronouncements:

In February 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02, “Leases (Topic 842)”, which requires the recognition of lease assets and lease liabilities by lessees for those leases classified as operating leases under previous GAAP. A lessee should recognize in the statement of financial position a liability to make lease payments (the lease liability) and a right-of-use asset representing its right to use the underlying asset for the lease term. For leases with a term of 12 months or less, a lessee is permitted to make an accounting policy election by class of underlying asset to not recognize lease assets and lease liabilities. In transition, lessees are required to recognize and measure leases at the beginning of the earliest period presented using a modified retrospective approach, which includes a number of optional practical expedients that entities may elect to apply. This guidance is effective for fiscal years beginning after December 15, 2021, with early application permitted. The Company is currently evaluating the effect that this guidance will have on its consolidated financial statements.

In June 2016, the FASB issued ASU 2016-13, “Financial Instruments – Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments.” The ASU applies to all financial instruments carried at amortized cost, including loans held for investment. The new accounting standard does not apply to loans held for sale or for financial assets for which the fair value option has been elected. This standard is effective for private companies to years beginning after December 15, 2022. The Company is currently evaluating the effect that this guidance will have on its consolidated financial statements.

In August 2018, the FASB issued ASU 2018-13, “Fair Value Measurement (Topic 820).” The ASU eliminates disclosures such as the amount and reasons for transfers between Level 1 and Level 2 of the fair value hierarchy. This standard is effective for all entities for fiscal years beginning after December 15, 2019. An entity is permitted to early adopt any removed or modified disclosures and delay adoption of the additional disclosures until their effective date. The adoption of ASU 2018-13 did not have a material impact on the consolidated financial statements.

In August 2018, the FASB issued ASU 2018-15, Customer’s Accounting for Implementation Costs Incurred in a Cloud Computing Arrangement That is a Service Contract, aligns the accounting for costs to implement a cloud computing arrangement that is a service with the guidance on capitalizing costs for developing or obtaining internal-use software. The Company adopted 2018-15 on January 1, 2021, with no material impact on the consolidated financial statements.

In March 2020, the FASB issued ASU 2020-04, “Reference Rate Reform (Topic 848).” The interest rate of the variable-rate indebtedness and the interest rate on the adjustable rate loans we originate and service is based on LIBOR. U.S.-dollar LIBOR is expected to be replaced with the Secured Overnight Financing

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 1. Summary of Significant Accounting Policies (Continued)

Rate ("SOFR"), a new index calculated by reference to short-term repurchase agreements for U.S. Treasury securities. The ASU contains guidance designed to simplify how entities account for contracts that are modified to replace LIBOR. The guidance will not apply to any contract modification made after December 31, 2022.

Note 2. Mortgage Loans Held for Sale

At December 31, 2020 and 2019, the Company had $411,282,272 and $305,580,368 outstanding in residential mortgage loans held for sale, respectively. The principal due upon maturity of mortgage loans held for sale at December 31, 2020 and 2019 is $399,133,510 and $296,808,947, respectively, which is $12,148,762 and $8,771,421 less than fair value, respectively. Mortgage loans held for sale serve as collateral for the Company’s lines of credit.

The Company enters into IRLCs with customers who have applied for residential mortgage loans and meet certain credit and underwriting criteria. These commitments expose the Company to market risk if interest rates change and the loan commitment is not economically hedged or committed to an investor. The Company is also exposed to credit loss if the loan is originated and not sold to an investor and the customer does not perform. The collateral upon extension of credit typically consists of a first deed of trust in the mortgagor’s residential property. Commitments to originate loans do not necessarily reflect future cash requirements as some commitments are expected to expire without being drawn upon.

At December 31, 2020 and 2019, the Company had outstanding IRLCs of $950,565,759 and $312,223,858 to customers, respectively. The Company expects to fund these commitments through the sale of the mortgage loans and borrowings under the Company’s lines of credit.

The Company’s policy is to hedge its loans held for sale and IRLC’s at various rates depending on market conditions. The Company economically hedges the changes in fair value of mortgage loans held for sale and IRLCs with TBAs and by entering into forward sale commitments with investors. At December 31, 2020 and 2019, the Company had commitments to deliver $666,992,364 and $250,601,666, respectively, in mortgage loans at specific rates and prices for TBA mortgage backed securities. The Company is exposed to credit loss in the event of nonperformance by the other parties to the TBAs and forward sale commitments; however, the Company does not anticipate nonperformance by the counterparties. In the years ended December 31, 2020 and 2019, the fair value adjustment on derivatives amounted to a net gain of $25,579,444 and $1,985,683, respectively. The Company also has forward sale commitments with specific investors to deliver specific loans held for sale at a specified price on a best efforts basis.

In certain cases, the Company may be required to repurchase loans and return fees received on loans sold that entirely prepay, default within a specified period after they are sold or if there is subsequent discovery that underwriting standards were not met. A liability of $1,130,542 and $716,467 has been recorded at December 31, 2020 and December 31, 2019, respectively.

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 3. Property and Equipment

Property and equipment, including amounts recorded under capital leases, at December 31, 2020 and 2019, consists of the following:

The net carrying value of assets held under capital lease arrangements at December 31, 2020 and December 31, 2019, was $238,381 and $74,607, respectively.

Depreciation and amortization expense was $2,295,432 and $2,759,615 for the years ended December 31, 2020 and 2019, respectively, which includes amortization of assets under capital leases.

Note 4. Mortgage Servicing Rights

Mortgage loans serviced for others are not included in the accompanying consolidated balance sheets. The unpaid principal balances of these loans at December 31, 2020 and 2019, consists of the following:

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Mortgage servicing rights, net of valuation allowance, are summarized as follows:

Estimated amortization expense of the mortgage servicing rights for the next five years is as follows:

Note 5. Warehouse Lines of Credit

The Company has a warehouse line of credit for mortgage loans with Bangor Savings Bank for $11,000,000, which expires on June 30, 2021. As of December 31, 2020, borrowings accrue interest at the 1 month LIBOR plus 1.85%. The principal balances owed on the line of credit as of December 31, 2020 and December 31, 2019 were $549,500 and $970,657, respectively.

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 5. Warehouse Lines of Credit (Continued)

The Company has a special purpose line of credit agreement (Hospital Line) with Bangor Savings Bank for $5,000,000, which expires on June 30, 2021. As of December 31, 2020, borrowings accrue interest at the Wall Street Journal prime rate plus 0%. The principal balance owed on the line as of December 31, 2020 and December 31, 2019 was $0 for each year.

The Company has a warehouse line of credit for mortgage loans with Truist Bank, formerly Branch Banking and Trust Company for $200,000,000, which expires on December 17, 2021. As of December 31, 2020, borrowings accrue interest at the greater of 1-month LIBOR or .75% LIBOR floor plus 1.75%. The principal balance owed on the line of credit as of December 31, 2020 and December 31, 2019 were $148,211,185 and $105,611,129, respectively.

The Company has a warehouse line of credit for mortgage loans with Wells Fargo Bank, N.A. (Wells Fargo) for $200,000,000, which expires 30 days after written notice has been delivered by either RMSI or Wells Fargo. As of December 31, 2020, borrowings accrue interest at 1-month LIBOR floor plus 1.75%. The principal balance owed on the line of credit as of December 31, 2020 and December 31, 2019 were $140,807,434 and $118,900,623, respectively.

The Company has a warehouse line of credit for mortgage loans with Flagstar Bank for $30,000,000, which expires on upon demand of either RMSI or Flagstar Bank. As of December 31, 2020, borrowings accrue interest at 1-month LIBOR floor plus 2%. The principal balance owed on the line of credit as of December 31, 2020 and December 31, 2019, was $11,890,114 and $4,182,746, respectively. The line also has a sublimit of up to $10,000,000 for construction loan advances and these borrowings accrue interest at 1-month LIBOR plus 2.5%. The principal balance owed on construction borrowings was $7,251,053 and $4,490,538 as of December 31, 2020 and December 31, 2019, respectively.

The Company has a warehouse line of credit for mortgage loans with US Bank National Association (US Bank) for $100,000,000, which expires on July 28, 2021. As of December 31, 2020, borrowings accrue interest at the greater of 1-month LIBOR or .50% LIBOR floor plus 1.75%. The principal balance owed on the line of credit as of December 31, 2020 and December 31, 2019 were $76,830,464 and $32,486,321, respectively.

The Company has a warehouse line of credit for mortgage loans with Comerica Bank for $75,000,000, which expires on March 16, 2022. As of December 31, 2020, borrowings accrue interest at LIBOR plus 1.75 percent. The principal balance owed on the line of credit as of December 31, 2020 and 2019 were $16,910,487 and $20,557,444, respectively. The line also has a sublimit of up to $20,000,000 for construction loan advances. These accrue interest at 1 month LIBOR plus 2.625%. The principal balance

owed on construction borrowings as of December 31, 2020 and 2019 was $15,278,680 and $10,874,582, respectively.

The Company has a warehouse line of credit for mortgage loans with First Horizon Bank, formerly First Tennessee Bank, for $25,000,000, which was terminated on September 30, 2020. As of December 31, 2019, borrowings accrued interest at 1-month LIBOR plus 2%. The principal balance owed on the line of credit as of December 31, 2020 and 2019 were $0 and $6,796,711. This line included a sublimit of up to $5,000,000 for construction loan advances. Borrowings accrued interest at 1-month LIBOR plus 2.5%. The principal balance owed on construction borrowings for both December 31, 2020 and 2019 was $0. The lines were paid off and closed upon termination.

The lines of credit are collateralized by assignments of the mortgages and notes funded by the lines of credit. Advance rates on the lines of credit range from 95% to 100% of the mortgage loan amount funded.

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 5. Warehouse Lines of Credit (Continued)

Lines of credit contain customary covenants, including, but not limited to, minimum levels of net worth, liquidity and profitability, and maximum levels of leverage. If the Company fails to comply with any of these covenants or otherwise defaults under a facility, the lender has the right to terminate the facility and require immediate repayment that may require the sale of the collateral at less than optimal terms.

In addition, if the Company defaults under one facility, it would generally trigger a default under the Company’s other facilities.

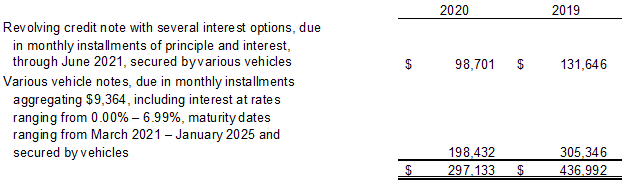

Note 6. Notes Payable

Notes payable at December 31, 2020 and 2019, consists of the following:

Maturities on notes payable are as follows for the years ending December 31:

Note 7. Stockholders’ Equity

Holdings is authorized to issue 161,800 shares of all classes of capital stock, consisting of 86,800 shares of common stock, $0.001 par value per share, 75,000 shares of preferred stock, $0.001 par value per share, 35,000 of which are designated as Series A Preferred Stock and 30,000 of which are designated as Series B Preferred Stock, and 10,000 shares of which are available for designation in one or more classes as defined.

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 7. Stockholders’ Equity (Continued)

The Series A Redeemable Preferred Stock is senior to all classes of stock and junior to all existing debt, and bears 12 percent cumulative dividends, compounded quarterly. No dividend is permitted to be paid or declared on the junior stock until payment in full of the Series A Preference Amount, as defined, to the holders of the Series A stock. The Series A shares are non-voting, redeemable at the discretion of the Company and mandatorily redeemable upon specified events. Series A holders have priority payment over Series B shares and common shares. In 2020, dividends totaling $26,317,465 were paid to holders of Series A Preferred Stock. In December 2020, the Company liquidated the Series A shares. The Series A liquidation preference was $0 and $41,875,559 at December 31, 2020 and 2019, respectively.

The Series B Convertible Preferred Stock is convertible into the common stock of Holdings at the option of the holder or at the time of a qualifying event, as defined, is junior to the Series A Redeemable Preferred Stock but senior to the common stock (unless converted) and bears 12 percent cumulative dividends, compounded quarterly. The number of shares of common stock to be issued upon conversion is based on the conversion price as defined. At December 31, 2020 and 2019, the Series B Convertible Preferred Stock is convertible into 30,000 shares of common stock. No dividend shall be paid or declared on any other series or class of junior stock until the Series B dividends are paid in full. The Series B liquidation preferences was $70,876,572 and $62,813,338 at December 31, 2020 and 2019, respectively.

The Series B shares have voting rights in proportion to the number of common shares into which they are convertible.

Pursuant to the Stockholders’ Agreement, the preferred stockholders are entitled to representation on the Board of Directors and have other rights as described in the Stockholders’ Agreement. If a management stockholder is terminated by the Company, the Company has the right but not the obligation to purchase any or all of such stockholder’s common shares at fair market value.

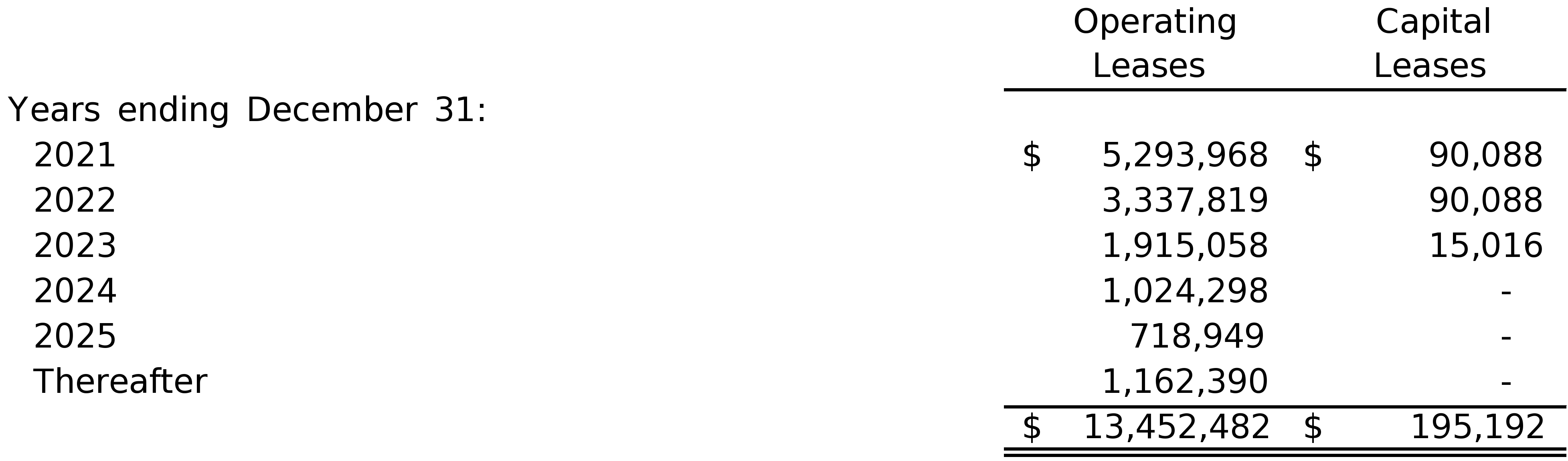

Note 8. Leases

The Company leases sales offices throughout its primary market areas, as well as certain office equipment and vehicles under noncancelable operating leases expiring at various dates in 2021 through 2028.

During the years ended December 31, 2020 and 2019, rent expense was $6,220,443 and $6,748,644, respectively. Rent expense attributable to related party leases was $693,675 and $730,425 for the years ended December 31, 2020 and 2019, respectively.

The Company leases certain computer equipment and software under capital lease arrangements which expire at various times until 2023. At December 31, 2020 and 2019, the outstanding balance related to the capital leases was $195,192 and $39,897, respectively.

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 8. Leases (Continued)

Future minimum obligations under all noncancelable leases are as follows:

Note 9. Retirement Plan

The Company sponsors a 401(k) plan covering all employees who meet minimum age and service requirements. Employees may contribute up to 100 percent of compensation. The Company matches 100 percent of contributions up to 4 percent of compensation. The Company recorded expense of $3,459,365 and $2,583,934, respectively, related to the plan for the years ended December 31, 2020 and 2019.

Note 10. Related Party Transactions

The Company periodically grants loans to stockholders and employees. Unsecured loans to stockholders and employees totaled $1,080,700 and $1,218,238 at December 31, 2020 and 2019, respectively.

The majority common stockholder is a partner in J.R. Seely Company, LLC and Seely & Vogel, LLC. The Company leases office space from J.R. Seely Company, LLC and Seely & Vogel, LLC under month-to-month lease arrangements. Rent expense for these arrangements were $607,425 and $674,625 in the years ended December 31, 2020 and 2019, respectively.

The Company leases office space and executive units from J.R. Seely Company, LLC and Seely & Vogel, LLC and rent expense attributable to the leases was $693,675 and $730,425 in the years ended December 31, 2020 and 2019, respectively. The future minimum lease obligations are $628,088 and $693,225 at December 31, 2020 and 2019, respectively.

The Company periodically advances funds to J.R. Seely Company, LLC and Seely Vogel, LLC. At December 31, 2020 and 2019, $1,274,771 was advanced and outstanding.

Note 10. Related Party Transactions

The Company executed an advisory services agreement for an annual fee of $500,000 payable monthly in advance to Eos Management, L.P., an affiliate of Eos Partners, L.P. and Eos Capital Partners, preferred stockholders of the Company. For both the years ended December 31, 2020 and 2019, the Company incurred advisory fees totaling $500,000, which are included in professional fees on the consolidated statement of operations.

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 10. Related Party Transactions (Continued)

The Company executed a consulting services agreement payable to a preferred stockholder of the Company. For the years ended December 31, 2020 and 2019, the Company incurred consulting fees totaling $360,253 and $247,127, respectively, which are included in professional fees on the consolidated statement of operations.

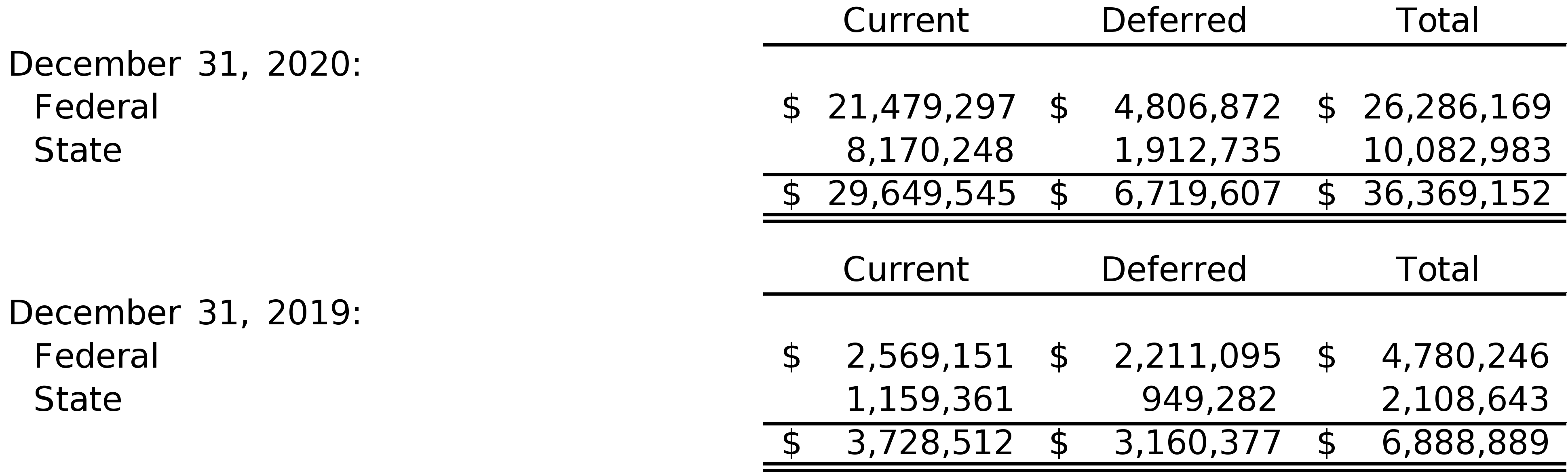

Note 11. Income Taxes

The current and deferred components of income tax expense were as follows for the years ended December 31, 2020 and 2019:

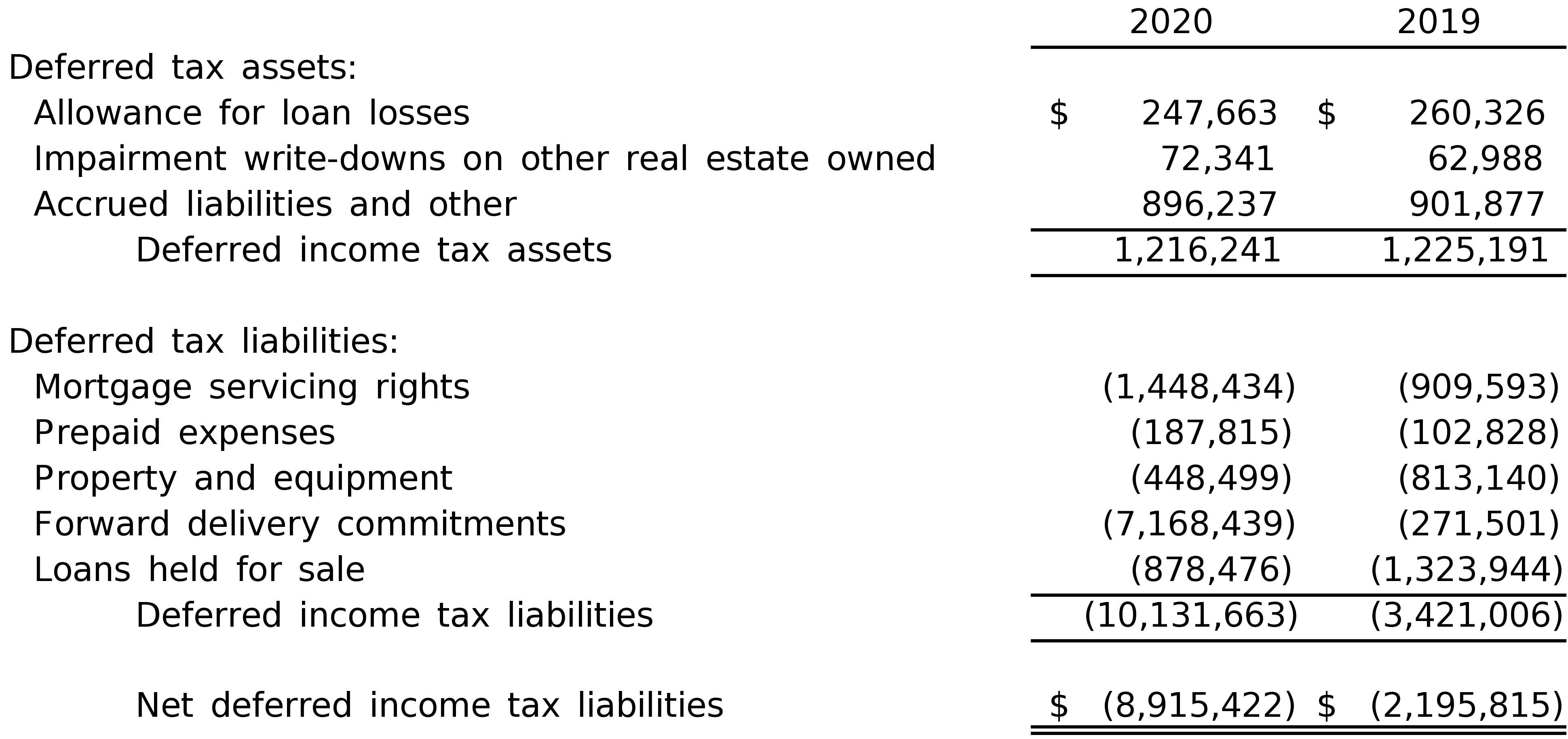

The items giving rise to the deferred income tax items in the consolidated balance sheet at

December 31, 2020 and 2019, are as follows:

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

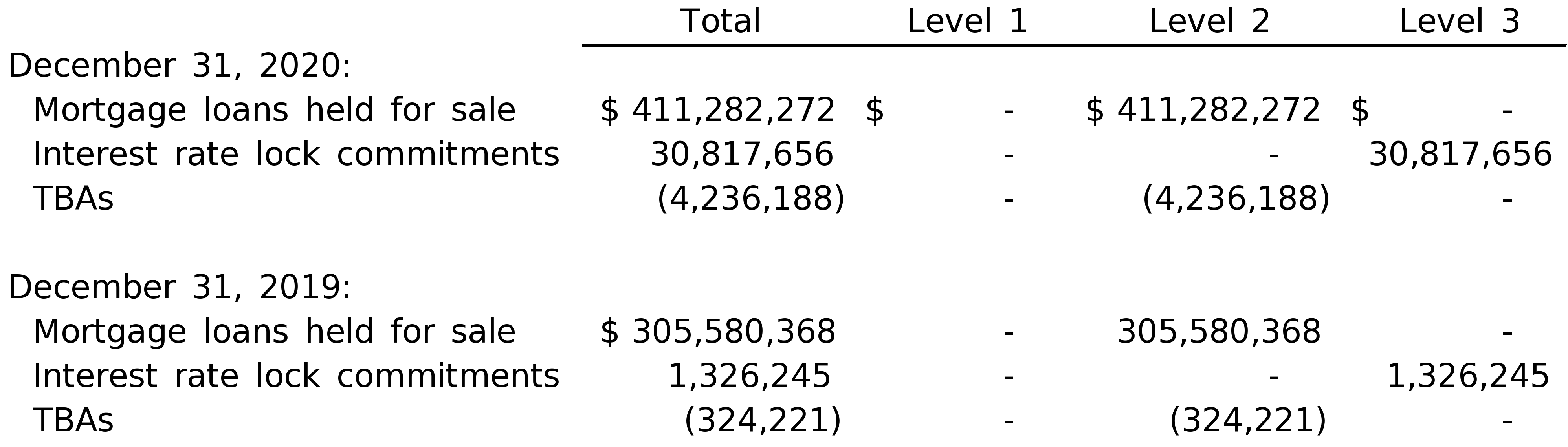

Note 12. Fair Value of Financial Instruments

The Company’s consolidated financial statements include assets and liabilities that are measured based on their estimated fair values. The application of fair value estimates may be on a recurring or nonrecurring basis depending on the accounting principles applicable to the specific asset or liability or whether management has elected to carry the item at its estimated fair value as discussed in the following paragraphs.

Financial assets and liabilities carried at fair value are classified and disclosed in one of the following three categories:

Level 1: Valuations based on quoted prices in active markets for identical assets or liabilities.

Level 2: Valuations for assets and liabilities traded in less active dealer or broker markets. Valuations are obtained from third party pricing services for identical or similar assets or liabilities.

Level 3: Valuations for assets and liabilities that are derived from other valuation methodologies, including option pricing models, discounted cash flow models and similar techniques, and not based on market exchange, dealer, or broker traded transactions. Level 3 valuations incorporate certain assumptions and projections in determining the fair value assigned to such assets or liabilities.

Fair value on a recurring basis: The table below presents the balances of assets and (liabilities) carried at fair value on a recurring basis at December 31, 2020 and 2019:

The following are descriptions of the valuation methodologies for instruments measured at fair value:

Mortgage loans held for sale and IRLCs: The fair value of the Company’s IRLCs and loans held for sale are based on the following assumptions:

•The assumed gain on the expected loan sale to the buyer using estimated prices observed in the market for loans with similar characteristics, mainly interest rate, term, and type of loan product (Level 2).

•The estimated premiums observed in the market for loans sold servicing-released (Level 2).

•The origination fee income, commission expense, and other conversion costs expected to be received or incurred for the resulting loans related to IRLCs (Level 3).

Residential Mortgage Services Holdings, Inc. and Subsidiary

| | |

| Notes to Consolidated Financial Statements |

Note 12. Fair Value of Financial Instruments (Continued)

•An estimate of the fall out expected from IRLCs that will not ultimately result in funded loans (Level 3).

TBAs and forward sale commitments: The fair value of TBAs and forward sale commitments is

estimated based on the market price movement of similar instruments from the trade date to the

reporting period-end date (Level 2).

Note 13. Commitments and Contingencies

The Company is party to litigation and claims arising in the normal course of business. Management, after consultation with legal counsel, believes that the liabilities, if any, arising from such litigation and claims will not be material to the consolidated financial statements.

Note 14. Subsequent Events

Management has evaluated subsequent events through March 31, 2021, which is the date the consolidated financial statements were available to be issued.

Subsequent to December 31, 2020, the Board of Directors of Holdings approved dividends of $18,500,532, payable to the Preferred Stock, Series B Holders in the first quarter of 2021.

Subsequent to December 31, 2020, the Board of Directors of Holdings approved dividends of $18,574,534, payable to the common stockholders in the first quarter of 2021.

Supplementary Information