UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

|

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended

OR

|

|

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _____________ to _____________

Commission file number:

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer |

|

|

|

|

(Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

|

|

|

|

|

|

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

☒ |

Smaller reporting company |

|

|

|

|

Emerging Growth Company |

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

As of June 30, 2020, the last business day of the registrant’s most recently completed second fiscal quarter, the registrant was not a public company, and therefore, cannot calculate the aggregate market value of its voting and non-voting common equity held by non-affiliates as of such date. The registrant’s Class A common stock began trading on the New York Stock Exchange on October 22, 2020.

As of March 18, 2021, the registrant had

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended, relating to the registrant’s Annual Meeting of Stockholders to be held on May 6, 2021, are incorporated herein by reference for purposes of Items 10, 11, 12, 13 and 14 of Part III of this Annual Report on Form 10-K. The definitive proxy statement will be filed with the Securities and Exchange Commission not later than 120 days after the registrant’s fiscal year ended December 31, 2020.

GUILD HOLDINGS COMPANY

Annual Report on Form 10-K for the Year Ended December 31, 2020

Table of Contents

|

|

Page |

|

|

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS |

|

|

|

|

|

|

|

3 |

||

|

|

4 |

|

|

|

10 |

|

|

|

21 |

|

|

|

21 |

|

|

|

21 |

|

|

|

21 |

|

|

22 |

||

|

|

22 |

|

|

|

22 |

|

|

|

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

23 |

|

|

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK |

41 |

|

|

42 |

|

|

|

ITEM 9. CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

72 |

|

|

72 |

|

|

|

72 |

|

|

73 |

||

|

|

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE |

73 |

|

|

73 |

|

|

|

73 |

|

|

|

ITEM 13. CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

73 |

|

|

73 |

|

|

74 |

||

|

|

74 |

|

|

|

78 |

|

2

PART I

Guild Mortgage Company, a California corporation, incorporated in 1960, was our operating company prior to our initial public offering (the “IPO”) and became a wholly-owned subsidiary of Guild Holdings Company, a Delaware corporation, incorporated in 2020, in connection with a series of reorganization transactions consummated in connection with the IPO. Prior to the consummation of the reorganization transactions and in reference to events which took place prior to the consummation of the reorganization transactions, unless the context requires otherwise, the words “Guild,” “we,” the “Company,” “us,” and “our” refer to Guild Mortgage Company and its consolidated subsidiaries. Subsequent to the consummation of the reorganization transactions and in reference to events which have taken place subsequent to the consummation of the reorganization transactions, unless the context requires otherwise, the words “Guild,” “we,” the “Company,” “us,” and “our” refer to Guild Holdings Company and its consolidated subsidiaries.

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Annual Report”) contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

Important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements include, but are not limited to, the following:

|

|

• |

any changes in macro-economic conditions and in U.S. residential real estate market conditions, including changes in prevailing interest rates or monetary policies and the effects of the ongoing COVID-19 pandemic; |

|

|

• |

any disruptions in the secondary home loan market and their effects on our ability to sell the loans that we originate; |

|

|

• |

any changes in certain U.S. government-sponsored entities and government agencies, including Federal National Mortgage Association (“FNMA”), the Federal Home Loan Mortgage Corporation (“FHLMC”), Government National Mortgage Association (“GNMA”), the Federal Housing Administration (“FHA”), the United States Department of Agriculture Rural Development (“USDA”) and the United States Department of Veteran’s Affairs (“VA”), or their current roles; |

|

|

• |

the effects of any termination of our servicing rights; |

|

|

• |

the effects of our existing and future indebtedness on our liquidity and our ability to operate our business; |

|

|

• |

any failure to maintain and improve the technological infrastructure that supports our origination and servicing platform; |

|

|

• |

any failure to maintain or grow our historical referral relationships with our referral partners; |

|

|

• |

any failure to continue the historical levels of growth in our market share in the mortgage origination and servicing industry; |

|

|

• |

any decline in our ability to recapture loans from borrowers who refinance; |

|

|

• |

our inability to attract, integrate and retain qualified personnel; our failure to identify, develop and integrate acquisitions of other companies or technologies, or any diversion of our management’s attention due to the foregoing; |

|

|

• |

inaccuracies in the estimates of the fair value of the substantial portion of our assets that are measured on that basis (including our mortgage servicing rights, or “MSRs”); |

|

|

• |

the failure of the internal models that we use to manage risk and make business decisions to produce reliable or accurate results; |

|

|

• |

the costs of potential litigation and claims; the degree of business and financial risk associated with certain of our loans; |

|

|

• |

any cybersecurity breaches or other attacks involving our computer systems or those of our third-party service providers; |

|

|

• |

any changes in applicable technology and consumer outreach techniques; |

|

|

• |

our inability to secure additional capital, if needed, to operate and grow our business; |

|

|

• |

the impact of operational risks, including employee or consumer fraud, the obligation to repurchase sold loans in the event of a documentation error, and data processing system failures and errors; |

3

|

|

• |

any repurchase or indemnification obligations caused by the failure of the loans that we originate to meet certain criteria or characteristics; |

|

|

• |

the seasonality of the mortgage origination industry; |

|

|

• |

any failure to protect our brand and reputation; |

|

|

• |

the risks associated with adverse weather conditions and man-made or natural events; our exposure to additional income tax liabilities and changes in tax laws, or disagreements with the Internal Revenue Service (“IRS”) regarding our tax positions; |

|

|

• |

any failure to adequately protect our intellectual property and the costs of any potential intellectual property disputes; |

|

|

• |

any non-compliance with the complex laws and regulations governing our industry and the related costs associated with maintaining and monitoring compliance; |

|

|

• |

any changes in the laws and regulations governing our industry that would require us to change our business practices, raise compliance costs or other costs of doing business; |

|

|

• |

our control by, and any conflicts of interest with, McCarthy Capital Mortgage Investors, LLC (“MCMI”); |

|

|

• |

the significant influence on our business that members of our board and management team are able to exercise as stockholders; |

|

|

• |

our dependence, as a holding company, upon distributions from Guild Mortgage Company to meet our obligations; |

|

|

• |

the risks related to our becoming a public company; |

|

|

• |

the risks related to our status as a “controlled company”; and |

|

|

• |

the risks related to our Class A common stock and our dual class common stock structure. |

You should not rely upon forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, results of operations and prospects. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors” and elsewhere in this Annual Report. Moreover, we operate in a very competitive environment. New risks and uncertainties emerge from time to time and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report. We cannot assure you that the results, events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results, events or circumstances could differ materially from those described in the forward-looking statements.

The forward-looking statements made in this Annual Report relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report to reflect events or circumstances after the date of this Annual Report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments we may make.

ITEM 1. BUSINESS

Guild Holdings Company, including our consolidated subsidiaries (collectively, “Guild”, the “Company”, “we”, “us” or “our”) is a growth-oriented mortgage company that employs a relationship-based loan sourcing strategy to execute on our mission of delivering the promise of home ownership in neighborhoods and communities across the United States. Our business model is centered on providing a personalized mortgage-borrowing experience that is delivered by our knowledgeable loan officers and supported by our diverse product offerings.

Guild was initially incorporated in California in 1960 as Guild Mortgage Company, and we are among the longest-operating seller-servicers in the United States. Over the course of our operating history, we have navigated numerous economic cycles and market dislocations. We have also expanded our retail origination operation to 32 states within the United States, and we have developed end-to-end technology systems, a reputable brand, industry expertise and many durable relationships with our clients and members of our referral network.

In 2007, seeing an opportunity to expand our sales and production strategy and grow our market share, a management-led partnership that included a majority investment from Fulcrum Mortgage, LLC, now known as McCarthy Capital Mortgage Investors, LLC, acquired the Company from its founder and created a California limited liability company, Guild Investors, LLC, as the parent entity. Following the acquisition, we embarked on a growth strategy focused on prudently expanding our geographic footprint beyond the West Coast. We expect to continue to expand our business in the geographic areas in which we already serve our clients, as well as in new markets throughout the United States.

Immediately prior to our initial public offering in 2020, we engaged in an internal reorganization that simplified our organizational structure, incorporating Guild Holdings Company in Delaware, making Guild Mortgage Company its wholly owned subsidiary and converted Guild Mortgage Company to a California limited liability company.

4

Our business model benefits from the complementary relationship between our origination and servicing segments which, together, have propelled our performance through interest rate and market cycles.

Our Business Model

Our origination strategy focuses on increasing our purchase-mortgage business and providing a superior personalized mortgage-borrowing experience that encourages our clients to return to us. This is successfully executed through a combination of our experienced loan officers, our technology platform, and diverse product offerings. Our business model provides clients with both a comprehensive digital interface and an experienced team that delivers high-tech, high-touch client service, allowing clients to engage with us in whatever format and frequency provides them the most comfort and convenience. This strategy allows us to generate consistent origination volume through differing market environments, contributes to our servicing segment and facilitates business from repeat clients.

Our in-house servicing platform creates opportunities to extend our relationship with clients and generates refinance and purchase volume that replenishes run-off from our servicing portfolio. In coordination with our portfolio recapture team, our loan officers handle recapture activity for their existing client base directly, rather than outsourcing that function through a call center. This approach creates a continuous client relationship that we believe encourages repeat business. In addition, our scalable servicing platform provides a recurring stream of revenue that is complementary to our origination business.

Business Segments

Origination

Retail Channel

Our retail channel, which makes up approximately 97% of our origination segment, focuses on serving our clients and referral partners in the markets we serve. We generate revenue through gain-on-sale and fees associated with originating and selling mortgage loans to the secondary market. We utilize warehouse facilities to fund originated loans and the mortgage loans are typically sold within 30 days of origination. After we sell originated mortgage loans to the secondary market, we generally retain the servicing rights on mortgage loans sold.

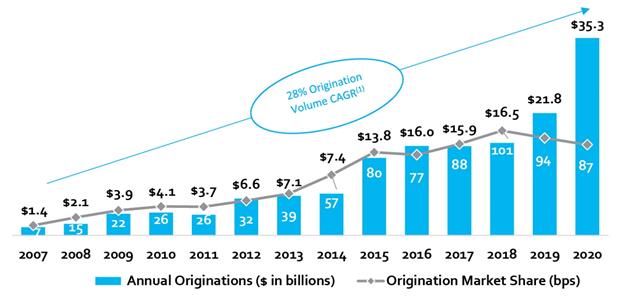

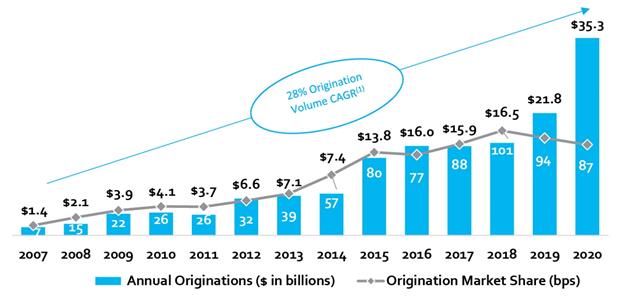

For the years ended December 31, 2020 and 2019 we originated $34.3 billion and $20.9 billion, respectively, in retail mortgage loan originations.

Our loan products are underwritten using a disciplined approach that focuses on credit risk and responsible lending. Our proprietary technology platform is regularly updated to incorporate new investor guidelines as well as state and federal regulations. These controls are designed to ensure integrity over data and qualification requirements, facilitate the manufacturing of quality loan originations and minimize underwriting defects. The loan products we offer include loans eligible for sale or securitization to secondary market participants such as the GSEs, Ginnie Mae, state housing agencies and other private or institutional investors. The underwriting guidelines for these products are established by the entities that will purchase, insure or guaranty the loans (i.e., Fannie Mae, Freddie Mac, the United States Department of Housing and Urban Development (“HUD”), the United States Department of Veterans Affairs (“VA”), the United States Department of Agriculture (“USDA”), private mortgage insurers and institutional and private investors). The majority of our loan products are sold to either Fannie Mae, Freddie Mac or Ginnie Mae.

Our success in the retail market is tied to the expertise of our loan officers and the strength of our referral partner network. We have built our referral network by providing our clients with a personalized mortgage-borrowing experience that is delivered by a knowledgeable loan officer. Our referral network relationships, including realtors, builders, existing clients, and financial planners, have been cultivated over years and are bolstered by our strong presence in the communities we serve. These referral partner network relationships enhance our ability to generate repeat business and recapture volume.

Correspondent Channel

In addition to the retail channel of our origination segment, we maintain an active correspondent channel that purchases closed loans primarily from small community banks and credit unions. We are able to offer a diverse product set through the correspondent channel, and similar to the retail channel, rely on our differentiated client service to generate origination volume.

We also utilize our correspondent channel to support our growth efforts. As we work to expand into new locations, the correspondent channel serves as an entry point to begin building our brand, reputation and client base.

Servicing

We have purposefully developed our in-house servicing platform and have invested significant resources expanding and upgrading its technology and infrastructure over time. The unique combination of in-house servicing and proprietary technology allows for enhanced servicing practices and embedded compliance controls throughout the system.

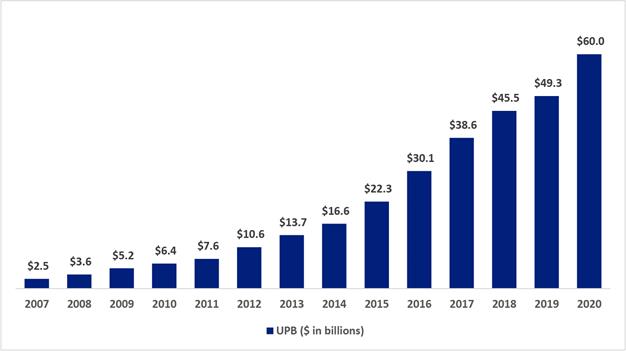

As of December 31, 2020, we served approximately 271,000 customers with an aggregate unpaid principal balance (“UPB”) of approximately $60.0 billion. Our loan servicing segment performs loan administration, collection, and default management activities, including the collection and remittance of loan payments; response to customer inquiries; accounting for principal and interest; holding custodial (impounded) funds for the payment of property taxes and insurance premiums; counseling delinquent borrowers; and supervising foreclosures and property dispositions.

5

Our servicing segment is based out of our servicing center in San Diego, California, and we are a licensed mortgage servicer in 48 states and the District of Columbia. Our primary source of revenue for our servicing operations is based upon a stated fee per loan that varies by investor. This fee is earned on a monthly basis as the borrower makes each payment.

As the owner of the mortgage servicing right (“MSR”), depending on the investors’ requirements and the loan program, we may be obligated to make servicing advances to fund scheduled principal, interest, tax and insurance payments when the mortgage loan borrower has failed to make the scheduled payments and to cover foreclosure costs and various other items required to preserve the assets being serviced.

Additionally, as the owner of the MSR, we generally have the right to solicit our clients for refinance opportunities. We leverage our technology platform and data repository to continuously screen our servicing portfolio in an effort to anticipate borrower actions and capitalize on recapture opportunities. When a refinance opportunity is identified, the portfolio recapture team sends that opportunity to the loan officer who originated the existing loan and maintains the client relationship. For select refinance opportunities, our consumer direct team will originate the opportunity directly.

Our Growth Strategies

Expansion into New Markets and Products

We regularly evaluate opportunities to grow our business, including expansion into new markets through acquisitions and organic growth through the recruitment of loan officers. Our retail operations cover 32 states and we believe by continuing to execute our growth strategy, we can grow our geographic footprint to include all 50 states over the long term. Our loan officer recruitment activities leverage our proprietary technology solutions to identify and recruit purchase-mortgage focused loan officers. We continue to develop new products to satisfy demand from clients in each of our origination channels and respond to changing circumstances in the market for mortgage-related financing.

We have successfully completed numerous acquisitions. Potential targets need to share our values and our commitment to innovation, creativity and collaboration. We prefer to partner with lenders that have a strong foothold in their market and a clearly defined approach to sustaining that success. Following an acquisition, we fully integrate each business operationally, on-boarding the acquired business to our platform, while allowing its management team to continue executing the strategy that has been successful for them in the past. After a target business has been integrated into the Guild platform, we strive to support growth organically in the same way we do in our existing markets. We also strive to generate synergies and support profitability by improving execution and increasing gain-on-sale margins for the businesses that we acquire.

Growing Retail Originations through Portfolio Recapture

In addition to targeting acquisitions and loan officers in new markets to grow our retail channel we also focus on recapturing our own portfolio. Recapture exists when we refinance a current client’s loan or when we help originate a current client’s new home purchase. By doing so, we continue the relationship with the client which presents not only an extended servicing revenue stream, but additional future origination opportunities. For the years ended December 31, 2020 and 2019, our recapture rate was 60% and 56%, respectively. For the years ended December 31, 2020 and 2019, our refinance recapture rate was 66% and 64%, respectively.

Growing our Mortgage Loan Servicing Portfolio

Our strategy is to retain a client for life and one of the ways we execute this strategy is to retain the mortgage servicing right after a loan is originated and sold to the secondary market. Through this strategy we expect to grow our overall servicing portfolio by adding new customers and retaining current customers within the portfolio.

Internally-Developed Technology Platform Underpins Loan Officer Productivity and Fosters Repeat Business

Our technology is differentiated in that we have one homegrown integrated platform for servicing and production. As a result, we control our lending process from start to finish and have created a personalized client experience from the time a loan officer takes an application through a loan’s closing, and until the loan pays off and we have an opportunity to recapture the client’s next transaction. The key components of this technology stack include:

|

|

• |

Guild to Go – A partner portal application that enables seamless interaction between Guild’s sales teams and our large referral partner network by providing an easy referral process, on-demand pre-approval letters and real-time milestone tracking |

|

|

• |

MyMortgage – A consumer digital interface that delivers a web- and mobile-friendly application process, document collection capabilities, client messaging and income/asset verification options |

|

|

• |

MyKey – Our proprietary Loan Origination System (“LOS”) that facilitates program eligibility and pricing, application review, underwriting, closing and servicing functions all on one integrated platform with built-in controls aimed to drive scalable operational efficiencies and favorable unit economics |

|

|

• |

Guild360 – A sales platform that supports marketing automation, email and calendar sync, lead and loan activity tracking, portfolio, servicing and retention campaigns, automated workflows and task assignments, texting and video functionality and predictive lead analytics capabilities supported by third-party data integration |

Our one proprietary platform drives loan officer productivity, operational scale and favorable unit economics. Our experienced loan officers use this end-to-end technology platform and our custom-built client relationship

6

management system to find new clients, close new loans and enhance and expand existing client relationships. This technology platform and our data repository has been developed over the course of our long operating history. By utilizing this data to further develop our platform and to curate suggested customer touchpoints, we foster a balanced combination of personalized and digital strategies for lead nurturing, as well as client education and communication, that we believe gives our loan officers a competitive edge.

In addition, our technology platform adds substantial value to loan officers that cannot be replicated or transferred to our peers. This helps us to generate strong loan officer loyalty and benefit from high retention rates among our top performing loan officers.

The majority of our technology used throughout our company is proprietary and developed internally by our own employees. We rely on a combination of trade secret laws and contractual agreements to establish, maintain and protect our intellectual property rights and technology. We enter into confidentiality and invention assignment agreements with our employees and enter into confidentiality agreements with third parties, including suppliers and other partners.

U.S. Mortgage Market and Competition

Mortgage loans are the largest class of consumer debt in the United States. According to the New York Federal Reserve, there was approximately $11.5 trillion of residential mortgage debt outstanding as of September 30, 2020. According to Inside Mortgage Finance, first lien mortgage loan origination volume was approximately $4.0 trillion in 2020.

The residential mortgage industry is characterized by high barriers to entry. Mortgage lenders must obtain approval from Freddie Mac, Fannie Mae and Ginnie Mae and maintain various state licenses in order to originate, sell and service conventional conforming and federal and GSE-backed loans. In addition, sophisticated technology, origination and servicing processes and regulatory expertise are required to build and manage a successful mortgage business.

The mortgage lending market is highly competitive. We compete with large financial institutions and with other independent residential mortgage loan producers and servicers. Competition can occur on the basis of the variety of product offerings, speed and convenience of execution in loan origination, interest rates and fees, client experience, technical knowledge, marketing and referral relationships. We aim to differentiate our products and services on the basis of our loan officers’ ability, leveraging our technology platform to match customers with the loan programs that best suit their needs and providing a customer-focused and seamless borrowing experience, starting from origination and continuing through servicing.

The mortgage origination industry can be seasonal. Accordingly, our loan origination revenues varies from quarter to quarter and comparisons of sequential quarters may not be meaningful.

Human Capital Resources

At the heart of our Company is our culture, grounded in strong values, innovation, creativity and collaboration. We believe our culture sets us apart and is the backbone of our success. It has enabled us to continuously innovate and evolve to navigate the dynamic mortgage market. This has given us the ability to attract, develop and retain top talent throughout our organization. As of December 31, 2020 we employed approximately 4,400 employees throughout the United States.

Guild is an inclusive organization and encourages open and honest dialogue across employees, clients and partners. We have a diverse leadership team that fills key roles in each of our business lines. Our leadership team has an average of 24 years of industry experience, has worked at Guild for an average of 21 years and includes top performers from the businesses that Guild has acquired. We have high employee retention, as well as a successful recruiting program, because we empower our employees, maintain a culture that supports collaboration and development and provide our employees with the tools and resources they need to be successful. Over the last 5 years, ending December 31, 2020, 80% of our originations are produced from loan officers who are still with us today.

Employee Retention and Development

We empower our loan officers through the Company’s coaching program, Elevate, designed to support loan officers at each stage of their careers. Elevate provides a roadmap to develop highly productive partnerships with referral networks. The program is taught by our highest producing loan officers and allows participants to learn effective solutions from their peers. The program also furthers our goal of creating a collaborative culture by engaging our national sales team to share best practices with their peers around the country. Participating loan officers have consistently achieved increased average productivity following participation in the program.

We have an internal online training system, Guild University, that is focused on all aspects of employee training, including employee development, productivity, management, and compliance.

Community Involvement

We believe strongly in supporting the communities in which we operate. To that end, Guild and its employees give back to the neighborhoods and communities we serve through sustained investment of time and resources, including through our Guild Giving Foundation. As encouragement to continue to give back to communities, Guild offers paid time off to our employees for volunteer hours. In addition, Guild Giving partially matches employee contributions to charities of their choosing. Throughout our branch locations as well as our corporate headquarters in San Diego, local community involvement is a continual part of connecting with the neighborhoods we serve. Being

7

involved in our local communities not only drives employee engagement, it also develops our referral network and enhances business relationships.

Employee Safety

The wellbeing and safety of our employees has always been a priority. In response to the COVID-19 pandemic, starting in March 2020, we moved to a remote working environment for the majority of our employees and, for those who are coming into our offices, we have instituted additional health and safety precautions, such as restricting visitors, providing masks and mandating more frequent sanitizing of our offices.

Regulation

The mortgage industry is subject to a highly complex legal and regulatory framework. Our business is subject to extensive regulation and oversight by federal, state and local governmental authorities, including the CFPB and various state licensing, supervisory and administrative agencies. From time to time, we also receive requests from such governmental authorities for records, documents and information relating to the policies, procedures and practices of our loan servicing, origination and collection activities. In addition, we are also subject to periodic reviews and audits from the GSEs, Ginnie Mae, the CFPB, HUD, the USDA, the VA, state regulatory agencies and others. The legal and regulatory environment in which we operate is also constantly evolving as statutes, regulations and practices, and interpretations thereof, that are in place may be amended or otherwise change, and new statutes, regulations and practices may be enacted, adopted or implemented.

These and other laws and regulations directly affect our business and require constant compliance monitoring and internal and external audits and examinations by federal and state regulators. We work diligently to assess and understand the implications of the complex regulatory environment in which we operate and strive to meet the requirements of this constantly changing environment. We dedicate substantial resources to regulatory compliance while at the same time striving to meet the needs and expectations of our customers, clients and other stakeholders. Notwithstanding these efforts, there can be no assurance that we will be able to remain in compliance with these requirements. See “Risks Related to Regulatory Environment” under the section titled “Risk Factors.”

Federal Regulation

We are subject to a number of federal consumer protection laws, including:

|

|

• |

the Real Estate Settlement Procedures Act (the “RESPA”) and Regulation X thereunder, which, among other things, (i) require certain disclosures to borrowers regarding the costs of mortgage loans, the administration of tax and insurance escrows, the transferring of servicing of mortgage loans, the response to consumer complaints, and payments between lenders and vendors of certain settlement services; and (ii) prohibit giving or accepting anything of value for the referral of real estate settlement services; |

|

|

• |

the Truth in Lending Act (the “TILA”) and Regulation Z thereunder, which, among other things, (i) require certain disclosures to borrowers about their mortgage loans, right to rescind some transactions, notices of transfer of ownership of mortgage loans, servicing rules involving payment processing, and adjustable rate mortgage change notices and periodic statements; (ii) require a reasonable and good faith determination by the lender that the borrower has the ability to repay the loan; (iii) require home ownership counseling for certain mortgage applicants and (iv) impose restrictions on loan originator compensation; |

|

|

• |

the Equal Credit Opportunity Act (“ECOA”) and Regulation B thereunder, which prohibit discrimination on the basis of age, race, color, sex, religion, marital status, national origin, receipt of public assistance or the exercise of any right under the Consumer Credit Protection Act in the extension of credit and require certain disclosures to credit applicants; |

|

|

• |

the Fair Housing Act, which prohibits discrimination in housing on the basis of race, color, sex, national origin, religion, familial status or disability; |

|

|

• |

Regulation N (the Mortgage Acts and Practices Advertising Rule), which prohibits deceptive claims in mortgage advertising and other commercial communications; |

|

|

• |

certain provisions of the Dodd-Frank Act, including the Consumer Financial Protection Act, which, among other things, prohibit unfair, deceptive or abusive acts or practices; |

|

|

• |

the Federal Trade Commission Act, the FTC Credit Practices Rules and the FTC Telemarketing Sales Rule, which forbids unfair or deceptive acts or practices and certain related practices; |

|

|

• |

the Telephone Consumer Protection Act (“TCPA”) and related laws that regulate communications via telephone, text, automatic telephone dialing systems, and artificial and prerecorded voices; |

|

|

• |

the Controlling the Assault of Non-Solicited Pornography and Marketing Act, which establishes requirements for those who send unsolicited commercial email; |

|

|

• |

the Fair Credit Reporting Act, as amended by the Fair and Accurate Credit Transactions Act, and Regulation V, which, among other things, regulate the use and reporting of information related to the credit history of borrowers; |

8

|

|

• |

the Home Mortgage Disclosure Act, and Regulation C thereunder, which require financial institutions to collect and report certain loan application, origination and purchase data; |

|

|

• |

the Gramm-Leach-Bliley Act and Regulation P thereunder, which, among other things, require the maintenance of privacy with respect to certain consumer data and periodic communications with consumers on privacy matters; |

|

|

• |

the Homeowners Protection Act, which requires the cancellation of private mortgage insurance once certain equity levels are reached, sets disclosure and notification requirements, and requires the return of unearned premiums; |

|

|

• |

the Secure and Fair Enforcement for Mortgage Licensing Act (“SAFE Act”), which requires all states to enact laws requiring each individual who originates residential mortgage loans to be licensed or registered as a mortgage loan originator; |

|

|

• |

federal anti-money laundering laws, including the Bank Secrecy Act and the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act, and the implementing regulations and sanctions programs of the United States Department of the Treasury; |

|

|

• |

the Electronic Fund Transfer Act of 1978 and Regulation E, thereunder, which provide certain protections for consumers engaging in electronic fund transfers; |

|

|

• |

federal financial protection statutes applicable to certain eligible service members, including the Military Lending Act and Servicemembers Civil Relief Act; and |

|

|

• |

the Bankruptcy Code and bankruptcy injunctions and stays, which can restrict collection of debts. |

We are also subject to a variety of regulatory and contractual obligations imposed by Fannie Mae, Freddie Mac, Ginnie Mae, the VA, the FHA and others.

In addition, the CFPB was established on July 21, 2010 under Title X of the Dodd-Frank Act to ensure that consumers receive clear and accurate disclosures regarding financial products and to protect consumers from unfair, deceptive or abusive acts or practices, among other things. The CFPB influences the regulation of residential mortgage loan originations and servicing in several ways. The CFPB has rulemaking authority with respect to many of the federal consumer protection laws applicable to mortgage originators and servicers, such as us, including the TILA, RESPA and the ECOA. The CFPB has been active and continues to amend rules and regulations within its purview. For example, the CFPB has issued rules and regulations that have expanded the scope of data required to be collected and reported for loan applicants and imposed requirements relating to repayment ability and qualified mortgage standards. These rules impose significant compliance burdens, for example, by requiring us to collect and submit data to regulators and to retain evidence of compliance, and any failures to comply, including any inadvertent errors, could result in the CFPB or other regulators imposing fines on or taking other enforcement actions relating to us.

The CFPB’s jurisdiction includes those persons originating, brokering, servicing or collecting residential mortgage loans and those persons performing loan modification or foreclosure relief services in connection with such loans. The CFPB has broad supervisory and enforcement powers with regard to non-depository institutions, such as us, that engage in the origination and servicing of home loans. The CFPB has conducted routine examinations of our business and we expect it to conduct future examinations. The CFPB can also bring enforcement actions, impose monetary penalties, require remediation of practices, pursue administrative proceedings or litigation and obtain cease and desist orders for violations of applicable federal consumer financial laws. The CFPB has been active in investigations and enforcement actions and has issued civil money penalties to parties when the CFPB has determined that such parties have violated the laws and regulations it enforces.

State Regulation

The SAFE Act requires all states to have laws that require individual mortgage loan originators employed by non-depository institutions, such as us, to be licensed to offer mortgage loan products. States also impose entity- and branch-level licensing obligations on us. As a result, we are subject to various state licensing requirements. These state licensing requirements generally require individual loan originators to register in a nationwide licensing system, submit information for a character and fitness review, submit to a criminal background check, complete a minimum number of hours of pre-licensing education, complete an annual minimum number of hours of continuing education and successfully complete an examination. Upon issuance of a license, we become subject to regulatory oversight, supervision and enforcement activity to determine compliance with applicable law. To conduct our residential mortgage operations in the United States, we are licensed in 48 states and the District of Columbia.

In addition to the above, state laws and regulations, among other things:

|

|

• |

require the filing of reports with regulators and compliance with state regulatory capital requirements; |

|

|

• |

impose maximum terms, amounts and interest rates, and limit other charges; |

|

|

• |

impose consumer privacy rights and other obligations that may require us to notify customers, employees, state attorneys general, regulators and others in the event of a security breach; |

|

|

• |

regulate servicing activities, including disclosures, payment processing, loss mitigation and foreclosure, servicing fees and escrow account administration; |

9

|

|

• |

prohibit discrimination and various forms of “predatory” lending and place obligations on lenders to substantiate that a client will derive a tangible benefit from the proposed home financing transaction and/or have the ability to repay the loan; |

|

|

• |

regulate whether and under what circumstances we may offer insurance and other ancillary products in connection with a lending transaction; and |

|

|

• |

provide for additional consumer protections. |

State laws and regulations, and interpretations thereof, vary from state to state, and these laws, regulations and interpretations may change and/or may be vague or interpreted only rarely.

Additionally, our business is subject to numerous state laws that are continuously changing, including laws related to mobile- and internet-based businesses, data privacy (including the California Consumer Privacy Act and similar or other data privacy laws enacted by other states) and advertising laws. One of our subsidiaries, Mission Village Insurance Agency, is also subject to certain laws and regulations governing insurance activities.

State attorneys general, state licensing regulators and state and local consumer protection offices also have the authority to investigate consumer complaints, commence investigations and other formal and informal proceedings, and take enforcement actions and impose remedies on or regarding our operations and activities.

See also “Risks Related to Regulatory Environment” under the section titled “Risk Factors.”

Available Information

Our corporate website address is https://www.guildmortgage.com. The content of our website is not intended to be incorporated by reference into this Annual Report or in any other report or document we file and any references to these websites are intended to be inactive textual references only.

ITEM 1A. RISK FACTORS

Investing in our Class A common stock involves risks. You should carefully consider the risks and uncertainties described below, together with all of the other information included in this Annual Report, including the financial statements and the related notes included in Item 8 of this Annual Report. Our business, financial condition, operating results, cash flow and prospects could be materially and adversely affected by any of these risks or uncertainties. In that case, the trading price of our Class A common stock could decline, and you could lose all or part of your investment. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties that we are unaware of or that we currently see as immaterial may also adversely affect our business. Some statements in this Annual Report, including statements included in the following risk factors, constitute forward-looking statements. Please refer to “Cautionary Note Regarding Forward-Looking Statements.”

Risks Related to Our Business

The COVID-19 pandemic has had, and will likely continue to have, an adverse effect on our business, and its ultimate effect on our business and financial results will depend on future developments, which are highly uncertain and cannot be predicted, including the scope and duration of the pandemic and actions taken or to be taken by government authorities in response to the pandemic.

The COVID-19 pandemic has negatively affected, and continues to negatively affect, the national economy and the local economies in the communities in which we operate and has created unprecedented economic, financial and health disruptions that have, and will likely continue to have, an adverse effect on our business. The pandemic has also caused significant volatility and disruption in the financial markets. In the event of a prolonged economic downturn or other economic disruption or changes in the broader economy, housing market, debt markets or otherwise, real estate transactions, the volume of mortgages we originate and the value of the homes that serve as collateral for the loans that we service may decrease significantly.

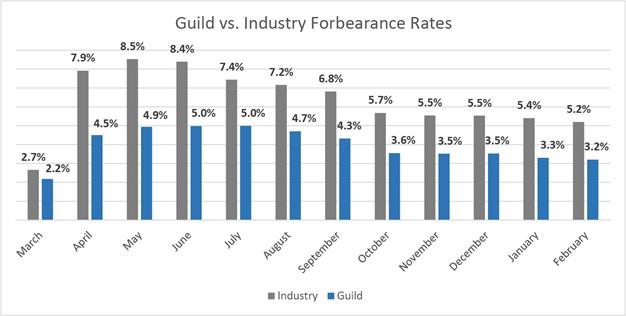

The COVID-19 pandemic is also affecting our mortgage servicing operations. The federal government enacted the Coronavirus Aid, Relief, and Economic Security Act (the “CARES Act”), which allowed borrowers with federally backed loans to request a temporary mortgage forbearance. In February 2021, the Federal Housing Finance Agency, the Department of Housing and Urban Development, the Department of Veterans Affairs, and the Department of Agriculture announced an extension of the forbearance period of three to six months depending on the loan type. As a result of the CARES Act forbearance requirements and the subsequent extension of federal forbearance programs, we have recorded, and expect to record additional, increases in delinquencies in our servicing portfolio, which may require us to finance substantial amounts of advances of principal and interest, property taxes, insurance premiums and other expenses to protect investors’ interests in the properties securing the loans. We expect that a borrower who has experienced a loss of employment or a reduction of income may not repay the forborne payments at the end of the forbearance period, or at all. Additionally, we are prohibited from collecting certain servicing-related fees, such as late fees, and initiating foreclosure proceedings. As a result, we expect the effects of the CARES Act forbearance requirements to reduce our servicing income, increase our servicing expenses and require significant unreimbursed cash outlays.

The COVID-19 pandemic may also affect our liquidity. We fund substantially all of the mortgage loans we close through borrowings under our loan funding facilities. Given the broad impact of COVID-19 on the financial markets, our future ability to borrow money to fund our current and future loan production and other cash needs is unknown. Our mortgage origination liquidity could also be affected if our lenders curtail access to uncommitted mortgage warehouse financing capacity or impose higher costs to access such capacity. Our liquidity may be further constrained as there may be less demand by investors to acquire our mortgage loans in the secondary market. In

10

addition, we may be required to use significant amounts of cash to fund advances for loans subject to forbearance requirements or that are delinquent.

Our business operations may also be disrupted if significant portions of our workforce are unable to work effectively, including because of illness, quarantines, government actions or other restrictive measures in connection with the pandemic. As a result of the pandemic, a significant portion of our employees has been working remotely. Although government authorities are in varying stages of lifting or modifying some of these measures, some have already, and others may in the future, reinstitute these measures or impose new, more restrictive measures if the risks, or the perception of the risks, related to the COVID-19 pandemic worsen at any time. Such restrictive measures could also slow certain aspects of our operations that depend on third parties such as appraisers, closing agents and others for loan-related verifications.

The extent to which the COVID-19 pandemic affects our business, results of operations, and financial condition will ultimately depend on future developments that are highly uncertain and cannot be predicted, including the scope and duration of the pandemic and actions taken by governmental authorities and other third parties in response to the pandemic.

A disruption in the secondary home loan market or our ability to sell the loans that we originate could have a detrimental effect on our business.

Demand in the secondary market for home loans and our ability to sell the mortgages that we originate depend on many factors that are beyond our control, including general economic conditions, the willingness of lenders to provide funding for and purchase home loans and changes in regulatory requirements. Our inability to sell the mortgages that we originate in the secondary market in a timely manner and on favorable terms could be detrimental to our business. In particular, we sell the majority of the mortgages that we originate to Fannie Mae, Freddie Mac and Ginnie Mae, and the gain recognized from these sales represents a significant portion of our revenues and net earnings. If it is not possible or economical for us to continue selling mortgages to the GSEs or other loan purchasers, our business, prospects, financial condition and results of operations could be materially and adversely affected.

Macroeconomic and U.S. residential real estate market conditions could materially and adversely affect our revenue and results of operations.

Our business has been, and will continue to be, affected by a number of factors that are beyond our control, including the health of the U.S. residential real estate industry, which is seasonal, cyclical, and affected by changes in general economic conditions, including the effects of the COVID-19 pandemic. Furthermore, our clients’ and potential clients’ income, and thus their ability and willingness to make home purchases and mortgage payments, may be negatively affected by macroeconomic factors such as unemployment, wage deflation, changes in property values and taxes and the availability and cost of credit. As a result, these macroeconomic factors can adversely affect our origination volume.

Increased delinquencies could also increase the cost of servicing existing mortgages and could be detrimental to our business. Lower servicing fees could result in decreased cash flow, and also could decrease the estimated value of our MSRs, resulting in recognition of losses when we write down those values. In addition, an increase in delinquencies lowers the interest income we receive on cash held in collection and other accounts and increases our obligation to advance certain principal, interest, tax and insurance obligations owed by the delinquent mortgage loan borrower.

We highly depend on certain U.S. government-sponsored entities and government agencies, and any changes in these entities or their current roles could materially and adversely affect our business, financial condition and results of operations.

A substantial portion of the loans we originate are loans eligible for sale to Fannie Mae and Freddie Mac, and government insured or guaranteed loans, such as loans backed by the FHA, the VA and the USDA eligible for Ginnie Mae securities issuance. The future of Fannie Mae and Freddie Mac (the “GSEs”), is uncertain, including with respect to how long they will continue to be in existence, the extent of their roles in the market and what forms they will have, and whether they will be government agencies, government-sponsored agencies or private for-profit entities. If the operation of the GSEs is discontinued or reduced, if there is a significant change in their capital structure, financial condition, activity levels or roles in the primary or secondary mortgage markets or in their underwriting criteria or if we lose approvals with those agencies or our relationships with those agencies is otherwise adversely affected, our business, financial condition and results of operations could be adversely affected.

Changes in prevailing interest rates or U.S. monetary policies may have a detrimental effect on our business. Our hedging strategies may not be successful in mitigating interest rate risk.

Our profitability is directly affected by changes in interest rates. The market value of closed loans held for sale and interest rate locks generally change along with interest rates. As such, volatility in prevailing interest rates may have a detrimental effect on our financial performance and results of operations. Many factors beyond our control impact interest rates, including economic conditions, governmental monetary policies, inflation, recession, changes in unemployment, the money supply, and disorder and instability in domestic and foreign financial markets. Changes in monetary policies of the Federal Reserve System could influence not only consumer demand for mortgages but also the fair value of our financial assets and liabilities.

We pursue hedging strategies to mitigate our exposure to adverse changes in interest rates, including with respect to loans held for sale and interest rate locks. Hedging interest rate risk, however, is a complex process, requiring sophisticated models and constant monitoring, and is not a perfect science. Due to interest rate fluctuations, hedged assets and liabilities will appreciate or depreciate in market value. The effect of this unrealized appreciation or depreciation will generally be offset by income or loss on the derivative instruments that are linked

11

to the hedged assets and liabilities. If we engage in derivative transactions, we will be exposed to credit and market risk. If a counterparty fails to perform, counterparty risk exists to the extent of the fair value gain in the derivative. Interest rate risk exists to the extent that interest rates change in ways that are significantly different from what we expected when we entered into the derivative transaction. In addition, we may not engage in hedging strategies with respect to all or a portion of our exposure to changes in interest rates at any given time, or may engage in hedging strategies to a degree or in a manner that is different from that of other companies in our industry. Failure to manage interest rate risk could have a material adverse effect on our business.

Our servicing rights are subject to termination with or without cause.

The servicing agreements under which we service mortgage loans for GSE and non-GSE loan purchasers require that we comply with certain servicing guidelines and abide by certain financial covenants. Under the terms of our master servicing agreements with the GSEs and non-GSEs that purchase the loans we originate, the loan purchasers generally retain the right to terminate us as servicer of the loans we service on their behalf, with or without cause. If we were to have our MSRs terminated on a material portion of our servicing portfolio, or if our costs related to servicing mortgages were increased by the way of additional fees, fines or penalties or an increase in related compliance costs, this could materially and adversely affect our business.

Our existing and any future indebtedness could adversely affect our ability to operate our business, our financial condition or the results of our operations.

Our existing and any future indebtedness could have important consequences, including:

|

|

• |

requiring us to dedicate a substantial portion of our cash flow to payments on our indebtedness, which would reduce the amount of cash flow available to fund working capital, capital expenditures or other corporate purposes; |

|

|

• |

increasing our vulnerability to general adverse economic, industry and market conditions; |

|

|

• |

subjecting us to restrictive covenants that may reduce our ability to take certain corporate actions or obtain further debt or equity financing; |

|

|

• |

limiting our ability to plan for and respond to business opportunities or changes in our business or industry; and |

|

|

• |

placing us at a competitive disadvantage compared to our competitors that have less debt or better debt servicing options. |

Failure to make payments or comply with other covenants under our existing debt instruments could result in an event of default. If an event of default occurs and the lender accelerates the amounts due, we may need to seek additional financing, which may not be available on acceptable terms, in a timely manner or at all. In that event, we may not be able to make accelerated payments, and the lender could seek to enforce security interests in the collateral securing such indebtedness, which includes substantially all of our assets.

Our mortgage loan origination and servicing activities rely on our loan funding facilities to fund mortgage loans and otherwise operate our business. If one or more of those facilities are terminated, we may be unable to find replacement financing at commercially favorable terms, or at all, which could be detrimental to our business.

We fund substantially all of the mortgage loans we close through borrowings under our loan funding facilities and funds generated by our operations. Our borrowings are in turn generally repaid with the proceeds we receive from mortgage loan sales. We currently, and may in the future continue to, depend upon several lenders to provide the primary funding facilities for our loans. As of the date of this Annual Report, we had eight warehouse lines of credit pursuant to master repurchase agreements, which provide us with an aggregate maximum borrowing capacity of approximately $3.0 billion. Additionally, as of December 31, 2020, we were party to (i) a term loan credit agreement with one of our warehouse banks, which agreement is collateralized by our Fannie Mae MSRs and provides for a term loan facility of $100.0 million (which can be increased to up to $150.0 million), (ii) a loan and security agreement with one of our warehouse banks, which agreement is collateralized by our Ginnie Mae MSRs and provides for a revolving facility of up to $135.0 million (which can be increased to up to $200.0 million) and (iii) a loan and security agreement with one of our warehouse banks, which agreement is collateralized by our Freddie Mac MSRs and provides for a revolving facility of up to $65.0 million.

In the event that any of our loan funding facilities is terminated or is not renewed, or if the principal amount that may be drawn under our funding agreements were to decrease significantly, we may be unable to find replacement financing on commercially favorable terms, or at all, which could be detrimental to our business. Further, if we are unable to refinance or obtain additional funds for borrowing, our ability to maintain or grow our business could be limited.

Our ability to refinance existing debt and borrow additional funds is affected by a variety of factors, including:

|

|

• |

limitations imposed under existing and future financing facilities that contain restrictive covenants and borrowing conditions that may limit our ability to raise additional debt; |

|

|

• |

a decline in liquidity in the credit markets; |

|

|

• |

prevailing interest rates; |

|

|

• |

the financial strength of the lenders from whom we borrow; |

|

|

• |

the decision of lenders from whom we borrow to reduce their exposure to mortgage loans due to a change in such lenders’ strategic plan, future lines of business or otherwise; |

12

|

|

• |

the amount of eligible collateral pledged on advance facilities, which may be less than the borrowing capacity of the facility; |

|

|

• |

the large portion of our loan funding facilities that is uncommitted; |

|

|

• |

more stringent financial covenants in our refinanced facilities, with which we may not be able to comply; and |

|

|

• |

accounting changes that impact calculations of covenants in our debt agreements. |

If the refinancing or borrowing guidelines become more stringent and those changes result in increased costs to comply or decreased origination volume, those changes could be detrimental to our business.

Our loan funding facilities contain covenants that include certain financial requirements, including maintenance of maximum adjusted leverage ratio, minimum net worth, minimum tangible net worth, minimum current ratio, minimum liquidity, positive quarterly income and other customary debt covenants, as well as limitations on additional indebtedness, dividends, sales of assets, and declines in the mortgage loan servicing portfolio’s fair value. A breach of these covenants can result in an event of default under these facilities and as such allow the lenders to pursue certain remedies. In addition, our loan facilities include cross default or cross acceleration provisions that could result in most, if not all, facilities terminating if an event of default or acceleration of maturity occurs under a facility. If we are unable to meet or maintain the necessary covenant requirements or satisfy, or obtain waivers for, the continuing covenants, we may lose the ability to borrow under all of our financing facilities, which could be detrimental to our business.

Our business depends on our ability to maintain and improve the technology infrastructure that supports our origination and servicing platform, and any significant disruption in service on our platform could harm our business, brand, operating results, financial condition and prospects.

Our ability to service our clients depends on the reliable performance of our technology infrastructure. Interruptions, delays or failures in these systems, whether due to adverse weather conditions, natural disasters, power loss, computer viruses, cybersecurity attacks, physical break-ins, terrorism, hardware failures, errors in our software or otherwise, could be prolonged and could affect the security or availability of our platform and our ability to originate and service mortgages. Furthermore, we may incur significant expense maintaining, updating and adapting our technology infrastructure, and our disaster recovery planning may be insufficient to prevent or mitigate these and other events or occurrences. The reliability and security of our systems, and those of certain third parties, is important not only to facilitating our origination and servicing of mortgages, but also to maintaining our reputation and ensuring the proper protection of our confidential and proprietary information and the data of mortgage borrowers and other third parties that we possess or control or to which we have access. Operational failures or prolonged disruptions or delays in the availability of our systems could harm our business, brand, reputation, operating results, financial condition and prospects.

Our risk management strategies may not be fully effective in mitigating our risk exposures in all market environments or against all types of risk.

We have devoted significant resources to develop our risk management policies and procedures and expect to continue to do so in the future. Nonetheless, our risk management strategies may not be fully effective in mitigating our risk exposure in all market environments or against all types of risk, including market, interest rate, credit, liquidity, operational, cybersecurity, legal, regulatory and compliance risks, as well as other risks that we may not have identified or anticipated. As our products and services change and grow and the markets in which we operate evolve, our risk management strategies may not always adapt to those changes in a timely or effective manner. Some of our methods of managing risk are based upon our use of observed historical market behavior and management’s judgment. As a result, these methods may not predict future risk exposures, which could be different or significantly greater than the historical measures indicate. Although we employ a broad and diversified set of risk monitoring and risk mitigation techniques, those techniques and the judgments that accompany their application cannot anticipate every economic and financial outcome or the timing of such outcomes. Any of these circumstances could have an adverse effect on our business, financial condition and results of operations.

Pressure from existing and new competitors may adversely affect our business, operating results, financial condition and prospects.

We operate in a highly competitive industry that could become even more competitive due to economic, legislative, regulatory and technological changes. We face significant competition for clients from bank and non-bank competitors, including national and regional banks, mortgage banking companies, financial technology companies and correspondent lenders. Many of our competitors are significantly larger and have significantly more resources, greater name recognition and more extensive and established retail footprints than we do.

Our ability to compete successfully will depend on a number of factors, including our ability to build and maintain long-term client relationships while ensuring high ethical standards and sound lending and servicing practices, the scope, relevance and pricing of products and services that we offer, our clients’ satisfaction with our products and services, industry and general economic trends and our ability to keep pace with technological advances in the industry.

Our failure to compete effectively in our markets could restrain our growth or cause us to lose market share, which could have a material adverse effect on our business, prospects, financial condition and results of operations. We may also face a competitive disadvantage as a result of our concentration in the northwest United States and will be unable, as compared to our more geographically diversified peers, to spread our operating costs across a broader market. Furthermore, a cyclical decline in the industry’s overall level of originations, or decreased demand for loans due to a higher interest rate environment, may lead to increased competition for remaining loan originations. Any

13

increase in these competitive pressures could have an adverse effect on our business, prospects, financial condition and results of operations.

Our failure to maintain or grow our historical referral relationships with our referral partners may materially and adversely affect our business, operating results, financial condition and prospects.

A substantial portion of our mortgage origination leads are sourced through an established network of referral partners with which we have longstanding relationships. We rely on being a preferred provider to realtors, builders and other partners with whom we have relationships. Our failure to maintain or grow these relationships could significantly decrease our origination volume and materially and adversely affect our business, operating results, financial condition and prospects. In addition, changes in the real estate and home construction industries, or in the relationships between those industries and the mortgage industry, could adversely affect our business and operating results, financial condition and prospects. For example, in recent years, there has been an increase in products and services designed to facilitate home sales without the involvement of realtors, and if the role of realtors in the sales process declines, our business could be adversely affected if we are unable to adapt to that development in a manner that preserves our loan origination leads.

We are required to make servicing advances that can be subject to delays in recovery or may not be recoverable in certain circumstances.

During any period in which our clients are not making payments on loans we service, including during defaults, delinquencies, forbearances and in certain circumstances where a client prepays a loan, we generally are required under our servicing agreements to advance our own funds to pay principal and interest, property taxes and insurance premiums, legal expenses and other expenses. In addition, in the event a loan serviced by us defaults or becomes delinquent, or to the extent a mortgagee under such loan is allowed to enter into a forbearance by applicable law or regulation, the repayment to us of any advance related to such events may be delayed until the loan is repaid or refinanced or liquidation occurs. Any delay or impairment in our ability to collect an advance may materially and adversely affect our liquidity, and delays in reimbursements of us, or our inability to be reimbursed, for advances could be detrimental to our business. Market disruptions such as the COVID-19 pandemic and the response, including through the CARES Act and the temporary period of forbearance that is being offered for clients unable to pay on certain mortgage loans may also increase the number of defaults, delinquencies or forbearances related to the loans we service, increasing the advances we make for such loans, which we may not recover in a timely manner or at all. In addition, any regulatory actions that lengthen the foreclosure process could increase the amount of servicing advances that we are required to make, lengthen the time it takes for us to be reimbursed for such advances and increase the costs incurred during the foreclosure process. While we have in the past utilized prepayments and payoffs to make advances, such sources, and other sources of liquidity available to us, may not be sufficient in the future, and our business, financial condition and results of operations could be materially and adversely affected as a result. As of December 31, 2020, loans representing approximately 3.5% of the loans in our servicing portfolio were in forbearance.

If we are unable to attract, integrate and retain qualified personnel, our ability to develop and successfully grow our business could be harmed.

Our business depends on our ability to retain our key executives and management and to hire, develop and retain qualified loan officers and other employees. Our ability to expand our business depends on our being able to hire, train and retain sufficient numbers of employees to staff our in-house servicing centers, as well as other personnel. Our success in recruiting highly skilled and qualified personnel can depend on factors outside of our control, including the strength of the general economy and local employment markets and the availability of alternative forms of employment. Furthermore, the spread of COVID-19 may adversely affect our ability to recruit and retain personnel. If the services of any of our key personnel should become unavailable for any reason, we may not be able to identify and hire qualified persons on terms acceptable to us, which could have a material and adverse effect on our business, operating results, financial condition and prospects.

A substantial portion of our assets are measured at fair value. If our estimates of their value prove to be inaccurate, we may be required to write them down, which could adversely affect our business and financial condition.

We record the value of our MSRs, interest rate lock commitments (“IRLCs”), mortgage loans held for sale (“MLHS”), the contingent liabilities related to our completed acquisitions and our inventory of loans for which we have repurchase rights at fair value. Fair value determinations require many assumptions and complex analyses for which we cannot control many of the underlying factors. If our estimates prove to be incorrect, we may be required to write down the value of these assets, which could adversely affect our earnings, financial condition and liquidity.