The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion, dated October 20, 2020

8,500,000 Shares

Guild Holdings Company

Class A Common Stock

This is the initial public offering of shares of Class A common stock of Guild Holdings Company. The selling stockholders identified in this prospectus are offering 8,500,000 shares of our Class A common stock. All of the shares of Class A common stock being sold in this offering are being sold by the selling stockholders. Guild will not receive any of the proceeds from the sale of the shares in this offering.

Prior to this offering, there has been no public market for our Class A common stock. We currently anticipate that the initial public offering price per share of our Class A common stock will be between $17.00 and $19.00 per share.

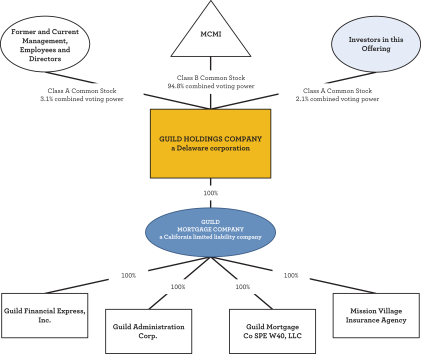

Following this offering, Guild Holdings Company will have two classes of authorized common stock. The Class A common stock offered hereby will have one vote per share. The Class B common stock will have 10 votes per share. McCarthy Capital Mortgage Investors, LLC (“MCMI”), an entity controlled by McCarthy Partners Management, LLC, a registered investment adviser (“McCarthy Partners” and, together with its affiliates, predecessors and the various funds it manages, including MCMI, “McCarthy Capital”), will hold 100% of our issued and outstanding Class B common stock after this offering and will control approximately 94.8% of the combined voting power of our outstanding common stock. As a result, MCMI will be able to control any action requiring the general approval of our stockholders, including the election of our Board of Directors, the adoption of amendments to our amended and restated certificate of incorporation and amended and restated bylaws and the approval of any merger or sale of substantially all of our assets.

We have applied to list our Class A common stock on the New York Stock Exchange (the “NYSE”) under the symbol “GHLD.”

We are an “emerging growth company,” as that term is used in the Jumpstart Our Business Startups Act of 2012, and, under applicable Securities and Exchange Commission (“SEC”) rules, we have elected to take advantage of certain reduced public company reporting requirements for this prospectus and future filings.

We will be a “controlled company” under the corporate governance rules for NYSE-listed companies and will be exempt from certain corporate governance requirements of such rules. See “Risk Factors—Risks Related to Our Organization and Structure,” “Management—Controlled Company” and “Principal and Selling Stockholders.”

Investing in our Class A common stock involves risks. See “Risk Factors” beginning on page 29 of this prospectus.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to selling stockholders, before expenses |

$ | $ | ||||||

| (1) | See “Underwriting” for additional information regarding the underwriting discount and certain expenses payable to the underwriters. |

The selling stockholders have granted the underwriters an over-allotment option for a period of 30 days to purchase up to an additional 1,275,000 shares of our Class A common stock.

At our request, the underwriters have reserved up to 425,000 shares of Class A common stock, or up to 5% of the shares of Class A common stock offered by this prospectus for sale, at the initial public offering price, to certain individuals associated with us. See “Underwriting—Reserved Share Program.”

Neither the SEC nor any state securities commission or other regulatory body has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of Class A common stock on or about , 2020.

| Wells Fargo Securities | BofA Securities | J.P. Morgan | ||

| JMP Securities |

| Compass Point | C.L. King & Associates |

The date of this prospectus is , 2020